Andrew Hallam

11.04.22

How To Boost Your Odds Of Growing Rich With Stocks

_

Imagine this. You had a nasty car accident and your left leg is a mess. A surgeon gives you one of two choices. One type of surgery provides an 85 percent probability that your leg will fully recover.

The alternative procedure comes with a 15 percent probability that your leg will be marginally stronger than it was before the accident, but an 85 percent chance that surgery will only make it worse.

Which would you pick? Most people would prefer the first surgical procedure. After all, that’s where the odds of success are best. Unfortunately, people don’t always apply that sort of logic to their investment decisions. The best odds of growing rich in the stock market come from building a diversified portfolio of ETFs. By doing so, you will beat about 85 percent of professional investors over your lifetime. That’s a well-known, academically peer-reviewed fact.

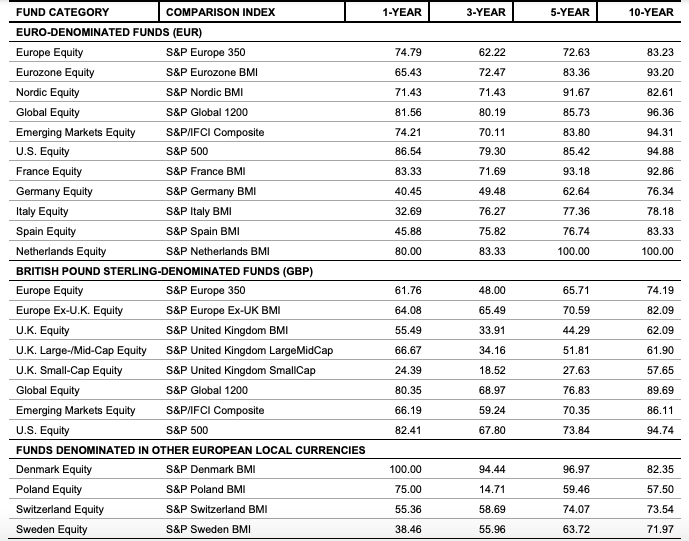

The SPIVA Scorecard demonstrates the percentage of professional European active managers who beat their benchmark indexes over the past one-year, three-year, five-year and ten-year periods.

For example, over the 10 years ending December 31, 2021, 83.23 percent of professional European fund managers underperformed the S&P Europe 350 while trading European shares. A whopping 96.36 percent of European fund managers trading global shares lost to the S&P Global 1200 Index. Among European fund managers dealing with US shares, 94.88 percent of them underperformed the S&P 500 over the past ten years.

You might notice that 100 percent of Dutch mutual fund managers dealing with stocks from the Netherlands underperformed the S&P Netherlands BMI Index. This doesn’t mean Dutch traders are worse than British traders, of which 62.09 percent underperformed the S&P United Kingdom BMI Index. Instead, this is random. Over the next ten years, professional British traders could perform far worse than traders from the Netherlands.

What’s more, the longer the time period measured, the higher the odds that an active manager will come up short.

This doesn’t mean European traders aren’t smart people. Based on research by Nobel Prize winning economist, William F. Sharpe, when we measure how active managers perform with their stock picks, they will always (as a group) equal the return of their benchmark indexes. That’s a mathematical, irrefutable premise because, as a group, they represent the money that is in that market. However, after fees and transaction costs, as shown above, most of them must underperform.

If you’re thinking about trying your hand as an individual stock picker or you would like to buy a hot mutual fund, it makes sense to recall that surgical example. The endeavor might go well at first. But over a lifetime, the odds of an actively managed portfolio beating a portfolio of ETFs are frighteningly low. And that’s why, as with the surgery decision, you boost your odds of growing rich by selecting the strategy with the highest probability of success.

It’s tempting to seek hot fund managers. But when we commit money to them, it’s often the kiss of death. As the SPIVA Persistence Scorecard shows, funds that perform well over one time period typically underperform the next. That’s why, paradoxically, it’s silly to buy an actively managed fund with a strong track record.

Hopeful investors who bought Cathie Wood’s ARK funds after their spectacular run are feeling that pain now. High net worth investors who bought the world’s most famous hedge fund are now disappointed, too.

Investing shouldn’t be exciting. If it is, you might be doing something wrong. Instead, it’s a lifetime endeavor with high odds of success…if you do it right. And doing it right is easy. British investors could buy an all-in-one portfolio of indexes, such as I mentioned here. Mainland Europeans, Irish investors, Canadians living in Europe and people from developing markets could buy a similar product, which I explain here. Canadian expats living outside mainland Europe and Australian expats could buy the products, which I mention here.

If you want to build lifetime wealth, these simple funds offer the best odds of success.

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.