Smart investing

Smart Investing

Why You Should Avoid Or Sell These Popular ETFs

_

"Smart investing isn’t about chasing past winners. Nor is it about predicting the future."

Smart Investing

The Real Reason Most Europeans Don’t Invest

_

Limited financial literacy and a preference for savings products force many European to retire later in life.

Smart Investing

Why John Bogle was Wrong and What It Means for Young Investors

_

It may seem counterintuitive, but consistently investing money in stagnating or falling markets can be a smart strategy for young investors.

Smart Investing

Just Starting Your Career? Save €30 A Day To Become A Multi-Millionaire

_

How to beat the government pension crunch with just €30 a day.

Smart Investing

Are You Afraid To Begin Investing?

_

Tempting as it may be to time your entry and wait for markets to fall from their all-time highs, history suggests that investing as early as possible is often the wiser financial choice.

Smart Investing

What’s A Better Investment, Real Estate or Stocks?

_

Conventional wisdom suggests that buying a property is a smarter financial move than renting. But could investing the same amount in the stock market yield a higher return?

Smart Investing

The World’s Best Investment Strategy Could Break The Dog House

_

Value investing: the standout strategy that made Warren Buffett rich.

Smart Investing

Investors can’t afford to overlook mainland China A-Shares any longer

_

We may be in the Year of the Dragon, according to the Chinese lunar calendar, but the country’s three major stock markets have lost their roar.

Smart Investing

Are You Confused By So Many Investment Choices?

_

Feeling lost in a sea of investment options? You're not alone! Navigating through 7000+ stocks and 9000+ ETFs can be overwhelming, just like having too many choices in life. Discover why fewer options might actually make you a better investor.

Smart Investing

Is It Wise To Begin Investing With Stocks At An All-Time High?

_

While conventional wisdom tells us investors should buy when prices are low and sell when they are high, the reality is very different. In fact, history shows markets tend to keep rising, even after hitting all-time highs.

Smart Investing

Should You Begin Investing Now, Or Wait?

_

History shows us that investing in financial markets as soon as feasibly possible will more often than not maximise your investment return over time.

Smart Investing

Dare To Compare Your Investment Results With Your Colleagues and Friends?

_

That isn’t the case for everyone. But comparing other people’s highlights to your day-to-day living can make you feel like a chump--if you lose perspective. The same warped comparisons can apply to your investments.

Smart Investing

If The US Election Causes The Dollar To Crash, Should You Hedge Your ETFs To The Euro or The Pound?

_

Many investors fear the US dollar will crash because of November’s US presidential election between Democratic incumbent Joe Biden and his Republican opponent Donald Trump.

Smart Investing

Why It’s The Wrong Time To Avoid Global Bond ETFs

_

The instinct to run from danger and towards opportunity helped us survive. Unfortunately, this same instinct makes us really bad investors.

Smart Investing

Do I Regret Selling My Berkshire Hathaway Shares? They Would Be Worth Almost $2 Million Today

_

You might think I was disappointed with the performance of my stocks. But I wasn’t. Berkshire Hathaway, itself, made me a lot of money. Read more

Smart Investing

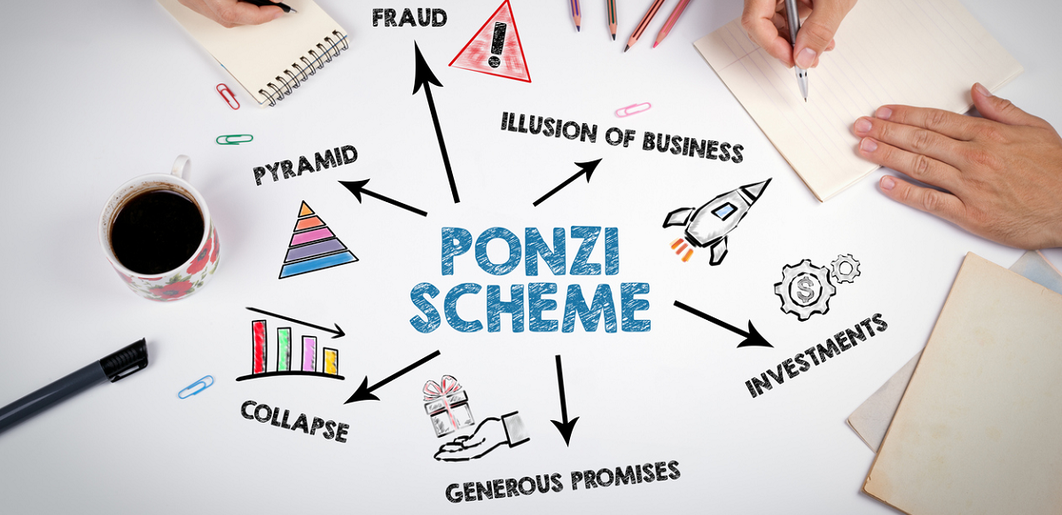

Why You Need To Pass The Investment Test I Failed

_

You’ve heard it before. Over your lifetime, it’s almost impossible to beat a portfolio of index funds on a risk-adjusted basis. But when someone says, “Invest with me. You can earn 20 percent per year,” it’s oh-so-tempting.

Smart Investing

Are you smart enough to make money out of artificial intelligence?

_

Investors who have been waiting for the next big thing appear to have found it in the artificial intelligence (AI) revolution. AI seems destined to change the world

Smart Investing

Are You Worried About Wars, Market Drops and a Messed Up World?

_

Just like market trends, humanity's journey has its ups and downs. But, despite the challenges we face, there's a positive, long-term trajectory. This week’s story draws parallels between human progress and the stock market. Click to learn more.…

Smart Investing

Why The FIRE Movement Began And Is Gaining Steam

_

A lower percentage of income is required to sustain ourselves today than at any other time in history. This article explains why and how that happened. It also explore two roads that are offered, diverging in a narrow wood.…

Smart Investing

Women Are Better Investors, And These Brave Men Admit It

_

Men, typically have higher stock allocations than women. As a result, they should perform much better, especially during periods when stocks soar. But they don’t.

Smart Investing

Why Donald Trump’s Court Cases and Wealth Should Influence Your Investments

_

Over the years, Donald Trump has invested in countless business ventures, TV appearances and a book. But you could have done better…without working a single day.…

Smart Investing

Why Do These Investors Want Their Portfolios To Drop?

_

Thirty seven year old entrepreneur, Jonathan Schrier, understands how investing works. That’s why he was thrilled to see stocks fall in 2022.

Smart Investing

What’s The Perfect Investment Allocation?

_

Portfolio allocation represents the different categories of investments that you are invested in. It’s your mix of asset classes. For example, large American stocks (Large-Cap US stocks) represent one asset class.

Smart Investing

How Would Aliens Rate Your Investment Decisions?

_

In Andrew Hallam's most recent article, aliens argue that humans make weird decisions about investing. Do you agree?

Smart Investing

Could You Match The Investment Returns of My Dead Uncle Arthur?

_

Building and maintaining a portfolio isn’t complicated. But most people can’t do it. That’s because, deep down, we sometimes believe that we, or someone we meet, can actually see the future.

Smart Investing

Why Vanguard LifeStrategy ETFs Are Still The Best Funds In Europe

_

If you’ve been investing for the past several years, you might be pulling your hair out. Perhaps you bought a great stock based on a solid track record. You might have purchased a fund that posted great performance and had a genius at the helm. Then the investments crashed.

Smart Investing

From theory to practice: Real ways to think about investing sustainably

_

It takes a lot of time – and even more smarts, research, and analysis – to successfully invest in individual stocks. So instead, many investors invest more broadly in specific countries or sectors using tools like funds.

Smart Investing

How Do We Convince People That The US Dollar Will Crash?

_

Joey Practicalis had come a long way from his days of studying Journalism at Yale University. He now worked for a global media firm.

Smart Investing

Sustainable investing in the next decade

_

Sustainable investing has taken off especially quickly in Europe but it’s facing a lot of political backlash in the US, with its relevance increasingly questioned against a low-growth and inflationary backdrop.

Smart Investing

When Should You Worry About Your Portfolio’s Returns?

_

If you’re one of my regular readers, you might expect me to say, “Ignore the market’s movements and your portfolio’s value. Just keep adding money.” I’m not saying that now.

Smart Investing

Why The Popularity Of Index Funds Might Peak or Decline

_

What would happen if everyone invested in index funds? I get asked this a lot. But unlike most index fund fans, I don’t sugar coat my answer.

Smart Investing

Robert Arnott’s Fundamental Index Packs A Solid Punch

_

Although critics call it a 200 page sales pitch for Research Affiliates, Andrew Hallam argues that The Fundamental Index, by Robert D. Arnott, John M. West and Jason C. Hsu deserves more than a furtive look.

Smart Investing

Inflation will soon peak. You need to be ready for what happens next

_

Inflation and interest rates could soon start falling, and faster than we think. When they do the investment conditions of the last year could swing sharply into reverse.

Smart Investing

Yields are back. It’s time to buy bonds while they’re still cheap

_

The bond market was tossing and turning throughout 2022, and investors are still feeling the aftershocks today. It’s on the move again and this may throw up a huge buying opportunity.

Smart Investing

Most British Expats Are Wrong About The Taxes They’ll Pay After Moving Back to Britain

_

Paul McCartney figured moving to the UAE was his ticket to ride. He worked for 25.5 different tech companies in the UAE over a 13-year span. Paul’s investment strategy was a bit helter skelter…

Smart Investing

Should You Really Be Investing In These Unprecedented Times?

_

In 2022, the falling stock and bond markets felt like a real-life horror show. Portfolios got sliced. Inflation poured Tabasco sauce over open wounds. The war in Ukraine continued to shake the world, and fuel prices spiked to nosebleed levels.

Smart Investing

Kiplinger’s Reveals The Best Performing Mutual Fund

_

Our investment lifetime has two phases. In the first phase, we’re adding money to the markets. In the second phase (retirement) we’re selling a sustainable amount each year.

Smart Investing

Emerging markets have just had a rotten year. That could soon change.

_

Remember when emerging markets were all the rage? Well done, because that was 20 years ago and an awful lot has happened since. Goldman Sachs economist Jim O'Neill gave the emerging markets craze a name in his research note Building Better Global Economic BRICs, published way back in 2001.

Smart Investing

Which Portfolios Did Best In 2022?

_

In 2022, a global earthquake hit the world’s financial markets. If portfolios were people, the hospitals would be full. But which portfolios did best?

Smart Investing

It’s Not Just About Fees: How Index Fund Investors Earn 100% More Than Active Investors Over 35 Years

_

Index Fund Investor vs. Active Investor – how fees and behaviour impact your earnings?

Smart Investing

2022 was tough. Things can only get better in 2023

_

Few investors will look back on 2022 with much fondness. Especially those who spent the previous decade loading up their portfolio with US tech and Bitcoin.

Smart Investing

Is FTX scandal the death of crypto or a buying opportunity?

_

2022 was a torrid year for Bitcoin and crypto-currencies, even before digital coin exchange FTX went into meltdown. One day FTX was valued at $32billion. The next, zero.

Smart Investing

Should You Move Money Into Gold During Turbulent Times?

_

Gold has always been considered a safe heaven in times of turmoil, but Andrew Hallam argues that gold is actually much more volatile than stocks.

Smart Investing

To Benefit From Bonds The Devil Is In The Details

_

Bonds were paying a paltry 1 or 2 percent interest rate per year. But when global banks increased interest rates and inflation accelerated, nobody wanted bonds that paid such low rates.

Smart Investing

Investors in ETFs: How Much Do You Know About Currency Risk and Performance?

_

Here’s a pop quiz. I’m going to ask five questions. Each of them reflects what plenty of investors have asked me over the past several years.

Smart Investing

Index Investing Isn’t As Popular As Headlines Suggest

_

Media headlines are designed to grab people faster than great smelling burgers at a county fair. But in our click-bait world of slippery leads, it’s good not to be misled.

Smart Investing

Here’s The World’s Best Stock Market Predictor

_

The ability to predict the stock market is like the Holy Grail. Unfortunately, there’s no shortage of bad forecasters who sell a bill of goods.

Smart Investing

Four Great Businesses That Might Be Lousy Stocks For Years

_

If you wanted to buy a handful of stocks, which would you pick? I’ve been asking people that question for more than 20 years. Most people say, “fast-growing businesses with exciting prospects.”

Smart Investing

Should You Try To Protect Your Wealth When Stocks Crash?

_

As global markets fall, could some kind of action save your portfolio?

Smart Investing

This year's volatility is showing us the importance of portfolio planning

_

When stock markets go haywire as they often do, it helps if you have drawn up a plan for your portfolio and can stick to it. If you don't, you could find yourself at the mercy of events, and make rash, panicky decisions that only add to your losses.

Smart Investing

The Weirdest Investing Truth

_

Would you invest in a bunch of companies that promise to change the world… businesses with rapidly increasing corporate earnings? Or, would you invest in a bunch of businesses with slow corporate growth?”

Smart Investing

Why currency matters – what the strong US dollar means for you

_

There is no doubt over which asset class has performed best in this troubled year – the mighty US dollar.

Smart Investing

How Investors Can Win When Stocks Fall

_

I’m 52 years old. I’ve been investing in the stock market for 33 years. And unlike most people, I like to see stocks drop. If you’ll be adding money to the markets for the next several years, you should be tap dancing to work when stocks fall. Before judging me birdbrain crazy, hear me out.

Smart Investing

Investors are fleeing risk. Soon they might regret it

_

As inflation skyrockets and global shares suffer a $13 trillion crash in the worst start to a year since 1932, now is surely the time to play it safe.

Smart Investing

The World’s Best Stock Market Tip

_

If you’ve watched a Marvel superhero movie, like The Avengers or Thor, you might recall Loki. Like Thor, the god of thunder, Loki’s character is based on Norse mythology.

Smart Investing

Stocks Are Falling Like a Monsoon Rain

_

Stocks are falling. Even bonds are down. Bitcoin is plunging like a bladeless helicopter. The most popular stocks of the early-pandemic era lead the spiral down.

Smart Investing

How Different Bond ETFs Have Performed This Year and Why?

_

This year, many investors feel much like that hiker, taking two steps forward then falling four steps back. Year-to-date, the S&P 500 index of US stocks has dropped about 22 percent to July 1, 2022.

Smart Investing

Investors: Chasing What’s Hot Could Leave You Naked On The Beach

_

Most people that abandon time-tested strategies do so when others appear to be making so much easy money. But people, unfortunately, are a lot like sheep.

Smart Investing

The Investment Paradox

_

I know a guy who, in 2009, put everything his family had in a handful of technology stocks. He didn’t own a house. He didn’t own bonds. In 2018 he showed me his brokerage account statement. This guy, who saved relatively modest sums, grew that money to several million dollars.

Smart Investing

How To Boost Your Odds Of Growing Rich With Stocks

_

Imagine this. You had a nasty car accident and your left leg is a mess. A surgeon gives you one of two choices. One type of surgery provides an 85 percent probability that your leg will fully recover. The alternative procedure comes with a 15 percent probability that your leg will be marginally stronger than it was before the accident, but an 85 percent chance that surgery will only make it worse.

Smart Investing

US tech shares CRASH – is this the buying opportunity of the year?

_

This year’s dramatic crash in the shares of US technology companies has wiped around $2 trillion off the valuations of household names such as Netflix, Amazon, Tesla and Facebook. Few private investors will have escaped the fallout. Even those don't hold these stocks directly may have exposure via actively managed funds or passive index tracking exchange traded funds (ETFs).

Smart Investing

Why Berkshire Hathaway Shares Are Soaring This Year

_

The stock market is, so far, stumbling in 2022. From January 1 to April 14th, the S&P 500 is down about 7.4 percent. Some of the best performers over the past few years have taken heavy hits. Facebook shares are down about 38 percent. Netflix shares have plunged almost 44 percent. Even Amazon dropped 9 percent.

Smart Investing

Why 100 Percent Stocks Might Earn You Less, Long-Term

_

Everyone knows how it feels to ride a bike with a flat tire. Perhaps you pulled a long-neglected bike from your garage. You were 12 years old, hankering for a chocolate bar, and it was the only way to get to the 7-11 corner store.

Smart Investing

Is Warren Buffett’s View On Bonds Making You Think Twice?

_

It’s currently one of the talked about quotes online: “Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.” Warren Buffett wrote this in his 2020 letter to Berkshire Hathaway shareholders.

Smart Investing

Zen and the Art of Investing For Your Future

_

“One of my grandfather’s went completely crazy,” said my student. “He was a really successful businessman. But around the time his personal wealth hit an all-time high, he started giving away all his possessions.He got rid of his business. He gave away his house and everything in it."

Smart Investing

Yes, There Are Savings Accounts That Pay High Interest Rates

_

In 2019, I spent the winter in Mexico. Mexican banks paid savings account holders about 3.5 percent per year. Plenty of Americans in Mexico celebrated with tacos and tequila. They told me, “I don’t need to keep my cash in a US bank account because I earn much higher interest in a Mexican bank.”

Smart Investing

What Russia’s Aggression Means For You and Your Portfolio

_

When Russia’s president, Vladimir Putin, ordered his military into Ukraine, he took a fire hose to a party that he wasn’t invited to. In many ways, it echoes December 1979, when the Soviets invaded Afghanistan.

Smart Investing

Who Wants To Be a Millionaire Expat?

_

Many of us wouldn’t mind receiving a call from a television game show host. “Hello, this is Bob Moneybags. I’m host of the series, Who wants to be an expat millionaire? We’re offering you a chance to win the riches of your dreams.”

Smart Investing

This Ghost Story Could Help Your Investment Asset Allocation

_

I’m going to share a ghost story. Hopefully, it will be helpful. But before I do, I’ll provide some context. For starters, investors with medium-risk portfolios comprising 70 percent stocks and 30 percent bonds could beat most investors that invest 100 percent in stocks.

Smart Investing

This is going to hurt – how inflation could destroy both stocks and bonds at the same time

_

Back to the 1970s – how inflation could destroy both stocks and bonds this year

So much for negative correlation – how stocks and bonds are set to crash at the same time

Smart Investing

Do You Wish Stocks Would Crash? That Might Not Be Crazy

_

Forty-one-year-old Eva Barnes and thirty-four-year-old Heidi Middleton were camping in the mountains of Arizona. As the evening temperature dropped, they built a fire and poured a couple of drinks. “Heidi, how long have you been investing in the stock market?” Eva asked.

Smart Investing

A Dumb Investment Mistake Even Smart People Make

_

A couple of years ago, I was giving an investment presentation at the Radisson Blu Resort, on the Mediterranean island of Malta. Afterward, the company’s manager invited my wife and me to dinner. I sat beside a wealthy British man who made his fortune in real estate.

Smart Investing

Dare you grab the Chinese tiger by its tail?

As China celebrates the Year of the Tiger many investors will be wondering whether the country’s stock market has lost its roar. Chinese GDP may have grown a better-than-expected 8.1% in 2021, but share prices crashed 21.64%, as measured by MSCI.

Smart Investing

2021 was another great year for investors. Will 2022 be even better?

_

As 2021 draws to a close, investors remain astonishingly calm. While politicians race to lock down as the Omicron variant spreads like wildfire, and US inflation soars to a 30-year high of 6.8%, global stock markets continue to trade near their all-time highs. Investors are also shrugging off other worries, including the Chinese property crash and the potential Russian invasion of the Ukraine. So can investors continue to keep their cool in 2022?

Smart Investing

Investors Aren’t Going Bananas Over Bonds Right Now

_

Have you ever left a piece of fruit on your kitchen counter for several days or a couple of weeks? I have. It’s disgusting. Uninvited families of ants stormed my kitchen. They telegraphed thousands of their closest friends. And as they dined on that fruit, they (the fruit, not the ants, unfortunately) began to shrivel. If I were starving when I came home, I suppose I could have eaten a dehydrated, mutilated, molding banana. But it likely would have led to diarrhea.

Smart Investing

How Investors Hurt Themselves with Cathie Wood’s ARK Funds

_

They built shrines for Cathie Wood. At least, that’s what it looked like on investment forums late in 2020. The fund manager had an evangelical following after embracing a strategy that wrecked so many dot-com investors twenty years ago - she filled all five of her ARK innovation funds with companies that had yet to earn an annual business profit.

Smart Investing

Yes, Spiderman Can Make You A Super Investor

_

The latest Spiderman movie, No Way Home, grossed $1 billion in just its first week. That makes it the pandemic-era’s highest selling film. It’s easy to love Peter Parker, the high school kid who was bit by a Krypton-esque super spider. It gave him freakish abilities to climb walls, sense danger and pound a UFC fighting champ with a single finger. But audiences relate to the guy’s very human flaws.

Smart Investing

Experts Say Stocks Are Going To Crash

_

I’ve been investing in the stock market for 32 years. Since I began investing, every week of every year a famous economist, a famous hedge fund manager or an esteemed journalist from a respected financial publication has headlined, “Stocks are heading for a crash.”

Smart Investing

Inflation is back - here’s how to protect your portfolio

_

What goes around comes around, they say, and after a break of more than 40 years inflation is finally heading our way. Many investors have never experienced a bout of inflation, and don't know what to expect. Those who lived through the "Great Inflation" of the 1970s do know, and they are worried.

Smart Investing

When Speculation Crashes

_

Will Ferguson doesn’t remember saying it. The Canadian English teacher was living in Japan and drunk at an after-work party. But his colleagues remembered what he said, and several weeks later, they continued to bring it up.

Smart Investing

Is This The World’s Largest Behavioral Experiment?

_

The driver took them to the entrance of a small, isolated run-down hotel. As soon as the passengers grabbed their bags and jumped out of the van onto the deep, still-falling snow, the driver turned the van around to head back to the city.

Smart Investing

Why European Bonds Will Look Great

_

It’s easy to hate European government bonds. Most pay paltry interest. Others have negative yields. They seem like freeloading guests who refuse to go home. But if you’re looking for a rant, it won’t come from me.

Smart Investing

Don’t Let Asset Allocation Drift into a Naked Dream

_

It was a normal day at my elementary school. I sat at my desk, tossing rolled up pieces of paper at the back of my friend’s head. Then the bell rang for recess. I got up and entered the packed hallway to grab a snack from my locker. That was when I froze in horror. I realized I was wearing nothing but underwear.

Smart Investing

The Best Investors In Index Funds And ETFs Would Have Been Eaten Alive

_

Grabbing his spear, the young Neanderthal knew where he could find an easy, yet somewhat risky meal. A large grizzly bear recently killed a deer. The bear ate what he wanted and then buried most of the carcass to save for later.

Smart Investing

How to Beat the Investment Returns of Almost Everyone You Know

_

Meg handed Jason a beer as they sat at an outside table. “If you could go back to 1993,” Meg asked, “would you do it?” It’s one of Meg’s favorite questions.

Smart Investing

Why the Best Investors are Like Rip Van Winkle

_

Stocks are going to crash. I don’t know when. But they will. US stock market CAPE ratios (a measure of expensiveness) are near an all-time high, and we haven’t had a double-digit calendar year decline for twelve years. In fact, over the past dozen years, we only had one calendar year drop: US stocks fell about 4.5 percent in 2018.

Smart Investing

When UK residents move abroad should they pack their investment portfolio too?

_

Moving to a new country is thrilling and exciting, but it also involves a lot of effort and responsibility, especially when it comes to managing your money. As well as dealing with a new country and culture, you also need to find somewhere to live, choose schools if you have kids, find a broadband supplier, and comply with the tax rules in your new jurisdiction.

Smart Investing

What's Better, Stocks or Real Estate?

_

In this column, Andrew Hallam discusses the merits and drawbacks of investing in the stock market and real estate. Which is better? What Would Make More Money, Stocks, or Real Estate?

Smart Investing

Where Are The Odds Better, Trading Currencies or Trading Stocks?

_

Trena saved money for several years, but she didn’t know what to do with it. Instead of investing it, she dumped it into her savings account.

Smart Investing

Should You Buy a Stock that’s Poised to Join the S&P 500?

_

Investors pin high hopes on stocks that are poised to join the S&P 500. They believe that when index fund providers add such shares, the companies stocks will soar. But in this article, Andrew Hallam explains that’s not the case.

Smart Investing

The simple route to investment success. Follow the 60/40 rule.

_

If your investment portfolio is in a mess, containing a ragbag of stocks and funds and crypto and anything else that briefly grabbed your attention, this simple rule could bring clarity in place of confusion. Invest 60% of your money in a spread of global shares, and 40% in bonds. And that’s it.

Smart Investing

What Percentage Should You Have In Stocks and Bonds?

_

I walked into the school’s photocopy room and saw one of my fellow teachers. I’ll call her Kim. She looked a bit dazed, so I asked her what was wrong. “My portfolio has lost half its value,” she said. “I was watching a guy on CNBC’s Squawk Box last night and he said the markets will fall further than they did in 1929.”

Smart Investing

More Women Are Flexing Their Financial Muscles Now

_

“If I looked like Brad Pitt, it might make more sense. But I don’t. Brad is seven years older than me. But he looks a lot younger. The guy has great hair. I’m bald. He barely has a winkle, and I’m reminded of all the sunscreen I didn’t wear. Yet, when I give financial talks, whether in person or on Zoom, I’m a big draw for women.

Smart Investing

Should You Fire Your Financial Advisor?

_

“My financial advisor retired,” said Joan Smith, “so I hired another advisor to manage my money.” I changed Joan’s name to protect her identity, but plenty of investors will relate to her story.

Smart Investing

Vanguard’s Life Strategy ETFs Might Be The Best Funds For Europeans, Canadians in Europe, Asians, Africans, South Americans and Investors From The Middle East

_

Anyone who suggests, “the best investment funds for you,” better have a darn good reason.

Smart Investing

Why Cathie Woods’ ARK Investors Aren’t Making Much Money

_

Cathie Wood’s ARK funds were the among the best performing ETFs in 2020. But in this article, Andrew Hallam explains why most investors in these funds haven’t made much money.

Smart Investing

Do you have enough exposure to fast-growing Asia?

_

Remember when everybody was saying this was the Asian century, and investors had to adjust their portfolios to match the new reality?

Smart Investing

Portfolio planning isn't what it used to be. It’s time to adjust

_

We live in unprecedented times, and that applies to investors as well. The financial crisis and Covid-19 pandemic have radically transformed many portfolio planning assumptions.

Smart Investing

Vanguard’s LifeStrategy Funds Might Be The Best Choice for British Expats

_

Andrew Popplewell has lived in the United Arab Emirates since 2005. But when the 47 year-old first left the United Kingdom, he didn’t know how to best invest his money. “We had some UK based unit trust [actively managed fund] investments,” he says, “and also a UAE portfolio bond.”

Smart Investing

Are Stocks At An All-Time High? Not If You Measure Right

_

Headlines read, “Stocks Are At An All-Time High!” But in this story, Andrew Hallam explains that stocks were more expensive 19 years ago.

Smart Investing

The Best Performing Stocks For 2021

_

In this article, Andrew Hallam explains how to invest in the best-performing stocks of 2021.

Smart Investing

What Investors Can Learn From Crazy and Not-So-Crazy Brits

_

When people gamble with their money, they usually do so with the hopes of a big reward. It doesn’t make sense to bet on an underdog when the payoff is low. But as Andrew Hallam explains in this article, that’s exactly what people do when they buy actively managed funds.

Smart Investing

Is inflation coming back and what should you do about it?

_

If you remember the 1970s, you will remember inflation, which struck fear into investors, economists, politicians and ordinary people alike.

Smart Investing

When Stocks Crash How Far Are You Going To Sink?

_

On Earth, the stock market is like that frozen lake. When stocks soar–as they have done for ten of the past eleven years– investors build sky-high expectations.

Smart Investing

Bonds With Added Benefits

_

Bonds aren’t intended to make your portfolio grow faster. Instead, they’re safety features designed to stop you from wrapping your portfolio around a pole.

Smart Investing

It pays to keep a cool head when markets lose their minds

_

This is a dizzying time to be an investor, as markets fly to record highs and bubbles pop up in the strangest of places.

Smart Investing

Why I don’t Include “Play Money” In My Portfolio

_

In this story, Andrew Hallam explains why he doesn’t include “play money” in his investment account.

Smart Investing

Don’t Turn Your Back On Diversification Now

_

In this story, Andrew Hallam says that when investors don’t properly diversify, they risk getting knocked out. And that devastating punch comes when they least expect it.

Smart Investing

Bitcoin won’t make you a millionaire today. It does have one use, though.

_

When I started this article, Bitcoin was trading at $58,306. By the time you read it, the price could be anywhere. The crypto-currency is giving a whole new meaning to the word volatility.

Smart Investing

Investors’ Great Expectations for Disruptive Technologies

_

George Gilder was God. At least, that’s what we thought. Gilder described a new paradigm that promised to change the world and commerce in magnitudes akin to the printing press, air travel, the telephone and electricity.

Smart Investing

Stock Market Solutions To Irrational Exuberance

_

In this article, Andrew Hallam asks if there’s anything investors should do about the stock market’s high level. After all, we’ve been here before. What can we learn from what happened then?

Smart Investing

Could You Beat the Market With These Ten Terrific Stocks?

_

They were public darlings and household names. Their corporate profits soared over the previous ten years. They were “can’t miss” stocks that thumped the S&P 500 by 143 percent.

Smart Investing

Should You Play In The Stock Market’s Casino?

_

“I make money roughly seven out of every ten years,” he says. “Sometimes the economy isn’t great or we have to update our facility. But there’s one mathematical certainty: even during years when the casino doesn’t earn a profit, we ensure that the players make less.”

Smart Investing

The Couch Potato Portfolio Makes Hedge Funds Look Silly

_

Imagine a planet similar to ours. Somebody creates a 2-speed bicycle. Others figure they can build something better. They add several gears. Then they add an internal combustion engine.

Smart Investing

Stock markets shrugged off coronavirus in 2020 and could do even better next year

_

Everybody agrees 2020 was a rotten year, and most people therefore assume stock markets had a rotten year too, but bizarrely, they didn’t.

Smart Investing

Why it matters where your investments are domiciled.

_

As any estate agent will tell you, the one thing that matters when buying property is “location, location, location”. It is the same when expats invest their money offshore.

Smart Investing

Why U.S. Stocks Will Disappoint Investors

_

Three days before the U.S. election, I watched a reporter on television interviewing people in Pennsylvania. “I’m voting for Donald Trump,” said one of the women. The reporter asked, “Why?”

Smart Investing

Smart Investing Is Simple, But That Doesn’t Make It Easy

_

I can teach you to thrash the performance of most professional traders. That might sound crazy, even boastful. But it’s true. You can trounce the performance of most hedge funds.

Smart Investing

How To Invest In These Uncertain Times

_

It looks like a perfect storm. There’s instability in America’s White House. That reality, alone, could hammer global markets. Experts say the recession will get worse. Several economic forecasts say inflation could hit 12 percent or more.

Smart Investing

Hot Investment Hands Are Like Sports Heroes

_

Investment heroes lose their mojo, too. But that’s tougher to predict. One year, they might bask at the top. The next year, they’re on the canvas, never to rise again.

Smart Investing

Most expats don’t know what margin trading is. They could be missing a trick

_

Should you ever borrow money to invest? Most expat investors would give a firm ‘no’ to that notion, and in most cases, they would be right.

Smart Investing

Investors: Don’t Stuff Logic in the Trunk of Your Car

_

You get behind the wheel of your car, put on your seatbelt and start the engine. You look for oncoming traffic before accelerating onto the street. In most cases, logic determines your decisions.

Smart Investing

Avoid US-domiciled ETFs unless you want to end up like Al Capone

_

Nobody wants to mess with the US Inland Revenue Services. These are the guys who took down legendary mobster Al Capone, remember.

Smart Investing

Searching the Best Mutual Funds For a Volatile Market?

_

So far, 2020 has been a wild ride for stocks. The S&P 500 gained about 4.2 percent from January 1st to February 19th. Coronavirus fears plunged stocks 34 percent from mid-February to March 23rd.

Smart Investing

Is Gold A Safe Life Boat Now?

_

Gold is much like a 10-person lifeboat. It usually sits neglected as cruise line guests dance to Shakira. However, when small waves tip a few dinner plates, one or two guests climb on board.

Smart Investing

Index-Linked Annuities Offer A Clever Sleight of Hand

_

The magician smiles as he removes his hat. He tips it to the audience so they can see inside. Then a dove flies out. Two seconds later, he winks, nods, then pulls out a rabbit. We know it’s a trick. But we’re often less certain when offered magical investment options.

Smart Investing

Ignore “Experts” Building Coffins for the 60/40 Investment Model

_

After 31 years of investing, here’s the most important thing I’ve learned: nobody can predict the future. Unfortunately, there’s no shortage of fortune-tellers. They claim to predict where stocks, bonds, gold, currencies or oil prices are going next. If I listened to those predictions, I might be broke today.

Smart Investing

One of the World’s Best Performing Portfolios During COVID-19

_

This year has been a fast, rickety roller coaster ride for stocks. COVID-19 nibbles at the track as investors fly up and down. Plenty of people can’t handle this sort of fear. They understand that stocks rise and fall. But they don’t have the stomach for the biggest market drops.

Smart Investing

Value Investors: Don’t Get Fooled By The Norse God, Loki

_

About 200 years ago, the Norse god, Oden, put the mischievous god, Loki in charge of the stock market. “Look, you little twerp,” he said. “Over 30-year durations, make sure the stock market earns between 7 percent and 11 percent per year. If it doesn’t, you’ll burn.”

Smart Investing

Have Netflix and Amazon Investors Gone A Little Crazy?

_

I had a nightmare last night.

Five burley men stormed my home. They dragged me by the hair to my laptop (I often dream about having hair). The biggest guy’s name was Jeff. He screamed, “Log in to your brokerage account! Sell everything!

Smart Investing

Are You An Investor Or A Speculator?

_

Several years ago, a couple of chaps with, perhaps, far too much time on their hands conducted an experiment. They analyzed the investment returns of more than 56,000 U.S. brokerage accounts over a six-year period. They wanted to figure out what kind of investors earned the best results.

Smart Investing

Why Do Index Funds Beat Actively Managed Mutual Funds?

_

Warriors with “actively managed funds” blazoned on their chests brought their spears out to fight. On the other side, academics raised flags in support of low-cost index funds.

The war ended years ago. Index funds won. But plenty of commission-hungry folk hope you didn’t get the memo.

Smart Investing

Why Bonds Are Like Bicycle Helmets…Especially Today

_

I glanced at the small computer on my handlebars as I flew down the steep hill. I was doing 57 miles per hour on skinny bicycle tires. It was 1987…and I wasn’t wearing a helmet. Back then, serious cyclists only wore helmets when they raced. And most of us wouldn’t have done that, if those weren’t the rules.

Smart Investing

Don’t fear the stock market crash. This is your chance to invest at bargain prices

_

People react to a crisis in different ways. Some run in shock, while others charge into the heat of the battle.

It’s the ancient ‘fight or flight’ physiological response to danger, and investors aren’t immune to it, quite the reverse.

When stock markets crash, as they have done due to the coronavirus, investors face competing impulses. Should they sell up and flee the market, or stand their ground and invest more?

Smart Investing

Financial Experts Trying To Time The Market Now

_

Who was the best basketball player of all time? If you hollered that question from an American sports bar, people would scream different names from every corner. The same thing might happen if you asked about history’s greatest tennis player, boxer, football player or hockey player.

But try asking this on Wall Street: Who is history’s greatest investor? You’ll likely hear one name: Warren Buffett. He’s among the four richest people in the world, despite the fact that, each year, he donates more money to charity than Donald Trump’s is worth.

Smart Investing

Investors: What If The Coronavirus Created Another 1929?

_

A couple of years ago I wrote, How A Stock Market Crash Could Accelerate Your FIRE. There’s a movement called FIRE that has nothing to do with burning. Instead, it stands for Financial Independence Retire Early. The column explained why young investors should prefer to see multiple year stock market drops. After all, market crashes allow them to buy stocks on sale. And when markets recover, such investors win big.

Smart Investing

Zen and the Art of Investing a Lump Sum

_

Caitlin slipped on her shoes and coat before walking down the path to her Toyota, which she had parked in front of her house. She opened the door, dropped into the driver’s seat and sat for a moment. Caitlin planned to meet a handful of friends that evening. It was a book club group that met once a month. But instead of talking about their most recent book, Caitlin had other ideas.

Smart Investing

It pays to keep your balance when markets crash

_

Don't panic. Stay calm. Be cool. As I write this, global stock markets are crashing around our ears, but you can survive the fallout, provided you strike the right balance.

The importance of building a balanced portfolio is a basic investment lesson that too many overlook, as they go chasing the next big thing.

Smart Investing

Are These The Toughest Conversations John Bogle’s Son Has?

_

I can imagine John Bogle Jr. on a camping trip. He meets a group of guys fishing off a dock. They talk about the weather and the fish before they introduce themselves.

Smart Investing

Will You Be Ready When Stocks Lose Big?

_

Early in 2012, I delivered an investment talk at Singapore’s United World College. After my presentation, a woman in the front row asked, "Why should we invest in the stock market? It hasn’t made money for years. Bonds and savings accounts make much more."

Smart Investing

What Investors Need To Know About These Growth Indicators

_

Abinash Duper scrambles out of bed and joins his father at the breakfast table. "This is going to be a great year," Mr. Duper tells his son. "Our company is doing well."

Smart Investing

Don't panic about stock market volatility. It could be your best friend

_

What's the single biggest thing that stops people from investing their money in stocks and shares?

Smart Investing

Become A Great Investor On Just 30 Minutes A Year

_

Alex Honnold clung to the vertical rock face of El Capitan. If his foot slipped or if his fingers cramped on a tiny hold, he would have fallen thousands of feet to his death. He wanted to be the first person in history to climb this legendary wall without a rope.

Smart Investing

How Australians And Canadians Can Invest Like Jedi Knights

_

In the 2017 film, The Last Jedi, Luke Skywalker reluctantly takes one last student. Her name is Rey. But Skywalker fears her natural power. What if Rey turns to the Dark Side, like Darth Vader and Kylo Ren had done?

Smart Investing

Have You Found Great Returns That Never Lose Money?

_

For 21 years, Allan Goldstein invested with a man who made him money every year. In 1990, U.S. stocks dropped about 6 percent. International stocks fell about 24 percent. But that year, Allen made close to double-digit gains.

Smart Investing

Outlook for 2020

_

Well that wasn't so bad, was it? Investors began 2019 in a glum mood, but the year turned out far better than expected.

Smart Investing

The Best Mutual Funds You Should Buy Right Now!

_

Steve Forbes is the Editor-in-Chief of Forbes magazine. It’s one of the world’s most respected financial publications. Its columnists have been churning out stories since 1917. For more than 100 years, they’ve been trying to forecast the direction of stocks and bonds.

Smart Investing

Are You Ever Too Old To Start Investing?

_

Lindsay’s eyes narrowed. I was delivering a presentation on investing, and she had a burning question. It was something many people think…but few have the courage to ask.

Smart Investing

Why British Stocks Are Set To Trounce U.S. Shares

_

Plenty of investors are like dogs chasing tails. They might say, "I’m going to buy this investment because it’s performing well." This, however, is as crazy as a talking poodle.

Smart Investing

Is now the perfect time to buy gold and what's the best way to do it?

_

I have a slight problem with gold. Deep down, I don’t trust it. That seems odd, given its fabled status as a store of value, but maybe that's the problem.

Smart Investing

Why Expats Often Buy The World’s Worst Financial Products

_

I call them the Septic Seven. They represent seven stinky financial products. Each product charges nosebleed fees…high enough to make cadavers flip.

Smart Investing

For Most Investors, 2019 Is Turning Out To Be A Really Bad Year

_

The year isn’t over. But U.S. stocks are up a lot. They soared more than 17 percent over the first nine months. Global stocks are up about 14 percent. Most investors, however, should be disappointed.

Smart Investing

Should Investors Fear The Inverted Yield Curve?

_

Plenty of investors focus on economic news. They worry about where stocks are headed. They want a quick heads-up so they can bob or weave in case stocks hit the skids.

Smart Investing

Why dividends are the most powerful force in the world

_

When I started investing more than two decades ago, the only thing that interested me was growth. I wanted to see my stock picks rise, and fast. This was the late 1990s when tech was booming and even taxi drivers were handing out tips.

Smart Investing

Which Currency Should You Pick For Your Diversified Portfolio Of Index Funds?

_

Imagine this for a moment. You’re a young, single person walking along a path and you stumble upon an ancient lamp with instructions on the side.

Smart Investing

Why Having Bonds In Your Portfolio Can Help Boost Returns

_

Most investors know they can make much more money with stocks than they can with bonds. But in real-world settings, most investors should include both asset classes in their portfolios.

Smart Investing

The Best Way To Invest Your Money

_

Hedge funds promise to make bucket loads of money during good times and bad. At least, that’s the myth. Reality is different. A diversified portfolio of index funds leaves most hedge funds in its dust.

Smart Investing

Clean funds save investors from dirty tricks

_

If you want to generate the best possible returns from investing, it helps if you can keep things clean. That means steering clear of the investment industry's dirty secret, the punitive charges that financial advisers and fund management companies continue to charge expats.

Smart Investing

You Just Sold a Business, a Second Home or Inherited A Windfall: Should You Hire a Professional Wealth Manager To Invest Your Money?

_

Have you recently sold your business and started looking at ways to reinvest your earnings? There are a number of things to consider.