Andrew Hallam

17.02.2020

Will You Be Ready When Stocks Lose Big?

_

Early in 2012, I delivered an investment talk at Singapore’s United World College. After my presentation, a woman in the front row asked, "Why should we invest in the stock market? It hasn’t made money for years. Bonds and savings accounts make much more."

That might sound crazy if we consider how stocks have soared lately. In 2019, U.S. stocks gained about 31 percent. Global stocks gained about 26 percent. If you invested $10,000 in Vanguard’s S&P 500 Index (VFINX) on January 1, 2010, it would have more than tripled to $35,166, ten years later.

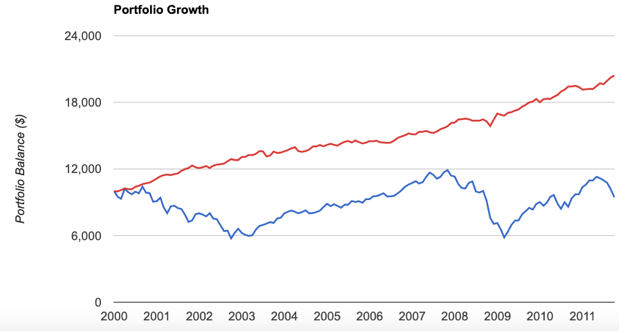

But in 2012, that woman was right. The previous decade was bad for stocks. If somebody had invested $10,000 in a U.S. stock market index in January 2000, it would have been worth about $9,500 by October 30, 2011. That’s almost 11 years without a profit. Below, you can see the performance of Vanguard’s S&P 500 index (VFINX) including reinvested dividends, compared to Vanguard’s Total Bond Market Index (VBMFX) with interest reinvested.

U.S. Stocks Didn’t Make A Profit For Almost 11 Years

January 1, 2000 – October 30, 2011

- Bonds - Stocks

Source: portfoliovisualizer.com, measuring Vanguard’s S&P 500 Index (VFINX) and Vanguard Total Bond Market Index (VBMFX)

Stock returns like these are brutal on the nerves. After a dismal stock market run, many people give up. They stuff money into savings accounts, bonds, gold, tin cans and mattresses.

Investors’ sentiment changes throughout a strong bull run. I’ve given investment seminars for about 17 years. When I began speaking to investors in 2003, most of them wanted to build portfolios with lower stock allocations…because stocks had dropped hard, three years in a row. At the time, experts in the media said things would get worse. That’s why many of those investors shunned high stock allocations.

By 2006, I noticed a shift. Stocks had climbed for three straight years, beating bonds in the process. New investors now said, "I want mostly stocks. I’ve seen the long-term returns over the past 100 years. Why would anyone want more than 10 or 20 percent in bonds? Long term, stocks beat bonds."

Then the financial crisis of 2008/2009 sent many scurrying for the ditch. Stocks dropped hard. Many of my friends gave up on stocks. The media stoked their fears. Here’s SmartMoney magazine cover from April 2009. The padlock, chain and featured stories freaked investors out.

PROTECT Your Money

• 5 Strong Bond Funds

• Where To Put Your Cash

• How To Buy Gold Now

SmartMoney magazine, April 2009

Stocks began to soar as this magazine hit the stands–and they just kept rising. But many of the people I spoke to (because of their fears) missed out on the early gains. Stocks kept rising for another eight years (2010-2018).

Between 2017 and 2019, I delivered more than 150 investment talks. Once again, many new investors said they didn’t want bonds. Once again, many said, "I’ve researched investment allocations. Over long periods of time, stocks thrash bonds." They, like so many others before, said they have what it takes to wait out market storms. But from what I’ve seen, many of them might not.

The markets will crash again. It might be this year. It might be next year. Nobody knows when, but crashes always come.

When the next crash comes, many of the same investors who chose low (or no) bond allocations in 2019 will want to protect themselves from further losses. They’ll rush into bonds, gold or cash, especially if stocks hit multiple year bleeds. That’s when the media’s experts, once again, will claim things are going to get worse.

This is why most investors perform poorly. They follow crowds. They follow rising asset classes. They follow public sentiment and they listen to their hearts. However, there’s a much better way. Investors should build a diversified portfolio of low-cost stock and bond market index funds or ETFs. They should maintain a constant allocation, year after year. They should ignore market levels, market forecasts, investors’ sentiments and investment magazines. Most importantly, they should be prepared to not make money if the markets start to slide. Success will come from patience and a long-term perspective.

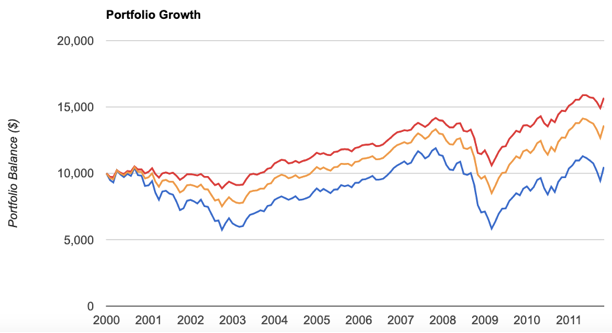

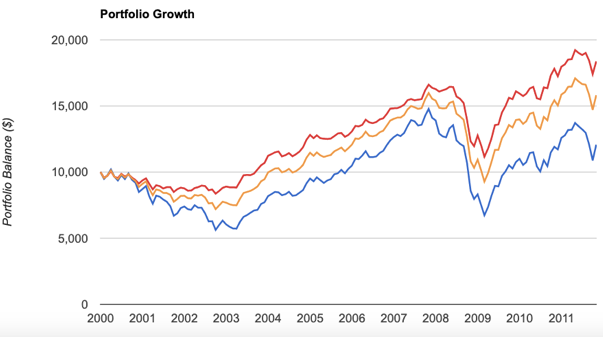

I’m not saying everyone needs to have bonds. But diversified portfolios of stocks and bonds help prevent investors from doing silly things when stocks fall apart. When stocks and bonds get rebalanced once a year, this can even push portfolios up when stocks go sideways. You can see examples on the two charts below. The first chart includes just U.S. stock and bond allocations. The second chart shows global allocations.

Portfolios With U.S. Stocks And Bonds Can Prevent Us From Giving Up

January 1, 2000 – October 30, 2011

- 100% U.S. Stocks - 70% U.S. Stocks, 30% Bonds - 50% U.S. Stocks, 50% U.S. Bonds

Source: portfoliovisualizer.com

Portfolios With Global Stocks And Bonds Can Prevent Us From Giving Up

January 1, 2000 – October 30, 2011

- 100% Global Stocks - 70% Global Stocks, 30% Global Bonds - 50% Global Stocks, 50% Global Bonds

Source: portfoliovisualizer.com

For more than ten years (2000-2011) U.S. and global stocks were beaten by inflation. It’s easy to find 100-year charts that show stocks beat bonds over long time periods. It’s easy to say, "I can handle volatility in search of bigger gains." But when people face adversity, what they think they’ll do and what they actually end up doing are often two different things.

In his book, Thinking Fast and Slow, the Nobel Prize winner in Behavioral Economics, Daniel Kahneman, says investors dislike losses twice as much as they like gains. People hate to see their hard-earned money bleed. That’s why most investors should maintain a diversified portfolio of stocks and bonds. Bonds pay paltry interest. But having bonds in the mix will help investors stay on course. If there’s one thing we know, stocks will one day crash again. And if they stay down for years, will you be ready for it?

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.