Andrew Hallam

09.04.2021

The Best Performing Stocks For 2021

_

History is littered with stories about great investors who knocked the lights out and then disappeared. No, nobody buried them in deserts or dropped them in the sea. Their investment strategies simply stopped working. In many cases, their high-flying funds crashed and their names joined the ranks of pop stars long forgotten.

But a rare few remain legends. People believe these investors have a special, magic touch. These super-investors include people like Warren Buffett, Benjamin Graham, Bill Ruane and Walter Schloss. They don’t beat the market every year. But by sticking to the same strategy, year in and year out, they beat the market, long term.

They might have had some luck, from time to time, but much of their ability can be explained. They took advantage of something known today as the value factor premium. This will likely go against every bone in your body. And that’s why it works.

Value stocks are cheap, relative to their corporate earnings. Their names rarely (if ever) get whispered around the water cooler at work. These are boring companies. But over long periods of time, boring beats sexy.

Sexy stocks are known as growth stocks. They’re typically high-flying businesses with a really great story. They include firms like Tesla, Amazon and Netflix. But over long periods of time, investors who focus solely on storied stocks don’t perform as well as those who buy the mundane. Legends like Warren Buffett, Benjamin Graham, Walter Schloss and Bill Ruane bought value stocks. And it’s easy to see why.

According to portfoliovisualizer.com, if $10,000 were split evenly between Large-Cap U.S. growth stocks, Mid-Cap U.S. growth stocks and Small-Cap U.S. growth stocks in 1972, it would have grown to $1,561,208 by March 31, 2020.

But if $10,000 were split between Large-Cap U.S. value stocks, Mid-Cap U.S. value stocks and Small-Cap U.S. value stocks it would have grown to a whopping $3,858,688.

Long term, value stocks win. But here’s what makes them tough to embrace, especially today: growth stocks have been on a decade-long run. This happens, from time to time. But it never lasts.

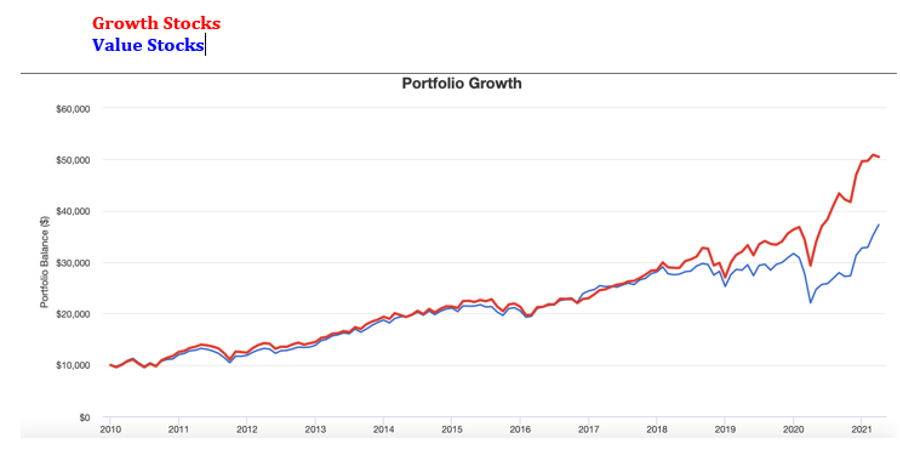

Below, I’ve shown a chart of the latest U.S. growth stock run. U.S. growth stocks averaged 15.48 percent per year from January 2010 to March 31, 2021. Value stocks, in contrast, averaged 12.41 percent. As shown on the chart below, growth stocks surged clear of value stocks in 2018.

January 1, 2010 – March 31, 2021

Source: portfoliovisualizer.com

*Based on equally splitting large-cap, mid-cap, and small-cap growth and value stocks

But the tide might be changing in a really big way. I’ll show what’s happening with U.S.-based funds. And then I’ll show what you could buy through your Swissquote brokerage.

Over the first three months of 2021, Vanguard’s Value Stock Index surged 12.43 percent. By comparison, Vanguard’s Growth Stock Index gained just 3.06 percent. Hot growth stocks like Tesla dropped 5.35 percent over the same time period. Amazon fell 5 percent and Netflix fell 3.53 percent for the first quarter of 2021.

There’s an even bigger performance gap with Mid-Cap stocks. Vanguard’s Mid-Cap Value Index gained 15.75 percent, compared to Vanguard’s Mid-Cap Growth Index, which gained 2.76 percent.

Globally, whether we’re talking about Canada, Europe, Emerging Markets or the United States, value stocks are beating growth stocks this year. Value stocks always tend to be cheaper than growth stocks, when comparing price-to-earnings ratios. But that price gap has never been wider than it is right now. That’s why the value stock resurgence could be strong and last for years.

Swissquote investors who want to put value to work could buy the iShares Edge MSCI World Value Factor ETF (IWVL). Over the first 3 months of 2021, it gained 13.05 percent. That compares to a gain of 4.0 percent for Vanguard’s FTSE All-World UCITs ETF (VWRA), which has a higher exposure to growth stocks.

If you want specific U.S. stock exposure, you could buy the iShares Edge USA Value Factor ETF (IUVL). It gained 18.4 percent during the first quarter of 2021, compared to about 7.4 percent for the S&P 500 and about 3.06 percent for U.S. growth stocks.

If you want to focus on European value stocks, the iShares Edge MSCI Europe Value Factor ETF (IEVL) could fit the bill. It gained 8.3 percent over the first three months of 2021, compared to about 5.6 percent for a plain vanilla European stock index.

While it’s tempting to jump back and forth between growth stocks and value stocks, investors really shouldn’t. When doing so, most will buy growth or value after a strong run. There’s comfort in crowds. But if want to put the genius of investors like Warren Buffett, Benjamin Graham, Walter Schloss and Bill Ruane on your side, consider sticking to value stocks through thick and thin. Sound easy? It isn’t. It’s more comfortable to bandwagon on the latest fad. That’s why so few people beat or match the market, long-term.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.