5.3 Measuring Risk part 2

Watch a practical example of risk management on a leveraged Forex trade.

Complete this course

Script

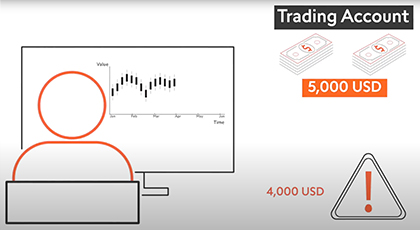

When trading, there are many different aspects to managing risk. A good trading plan provides clarity on how much risk to accept in total, and how much to take on any given trade. Keep in mind that choosing winning trades does not necessarily result in overall profitability; traders must ensure that – on average - winning trades run longer than losing trades. By ensuring that you take profits that are greater than your losses, you reduce the ratio of how often you need to be right about a trade. Let’s see how that works in practice in this example. Imagine a trading account of 10,000 US dollars. 5,000 are already spoken for in other trades, so there are 5000 US dollars to leverage 1 to 100, providing 500,000 US dollars worth of trading. Note, though, that this is based on 5,000 US dollars in the account, which is the maximum loss, and holding a little in reserve for slippage, let’s set a risk appetite of no more than 4,000 US dollars. The 4,000 US dollars, leveraged at 100:1, will buy 4 lots of EURUSD at 1.0045 dollars per euro. Since the value of one pip when buying one lot is 10 USD per pip, for four lots, the value of one pip is now 40 USD per pip. Based on careful market analysis, lets set the stop loss order at 15 pips below the entry price. With a risk to reward ratio of 1 to 3, the take profit order should be placed 45 pips above. Before entering the orders, multiply the number of pips by the pip value to ensure that the risk is within the risk appetite. No problem! For large trades, many traders take profits gradually in order to lock in profits and grow their equity.