5.4 Quizz

1. How can we mitigate risks?

By diversifying our investment portfolioBy trading only during certain timesThe two answers above are correctNone of the above

Justification: We can mitigate risks by diversifying our investment portfolio, by trading only certain times or by limiting our trade sizes/hedge.2. Which of the following statements is wrong?

The prioritisation of each trade is not a way for insightful traders to practice risk management.When you invest, there is no guarantee that you will make money.Specific risk affects only one specific asset while systematic risk affects many assets at the same time.We can calculate the pip value for a given trade to measure the risk.

Justification: Insightful traders practice risk management, which consists of identification, analysis and prioritization of each trade.3. Choose a possible way to measure risk.

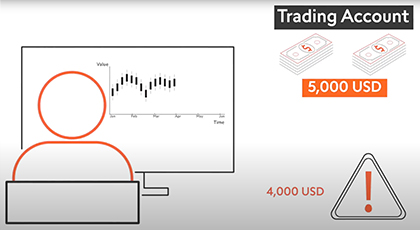

Calculate the pip value for a given tradeNote the volatility of the assetThe two answers above are correctNone of the above

Justification: Indeed, we can measure risk by defining a trade size, calculating the pip value for a given trade and noting the volatility of the asset. 4. Please complete the following sentence: ____________ ensure that on average winning trades run longer than losing trades.

Profit/Loss ratioVolatilitySpreadRate difference

Justification: A spread is the difference between buying and selling price. Volatility serves as a parameter for quantifying the yield and price risk of a financial asset. The rate difference is the difference between two rates.Complete this course

Open questions? Download our eBook!

If you want to know even more you can quench your thirst for knowledge with our comprehensive eBook.

How to manage risk in ForexCongrats!

You are ready for the next step!

Looks like you are well on the way to become the next expert in Forex.

Try the real deal by opening an account!