Andrew Hallam

27.11.2020

College Endowment Managers Wanted: Easy Prestige and Money

_

How would you like to manage an Ivy League endowment fund? Yes, it sounds tough. But you could do it. The job description might say they’re looking for a genius. Don’t let that turn you off. When it comes to investing, common sense beats Mensa.

This is even simpler than it sounds. In fact, you could beat most of your professional peers without any work. That might sound like bunk. But hang with me for a moment.

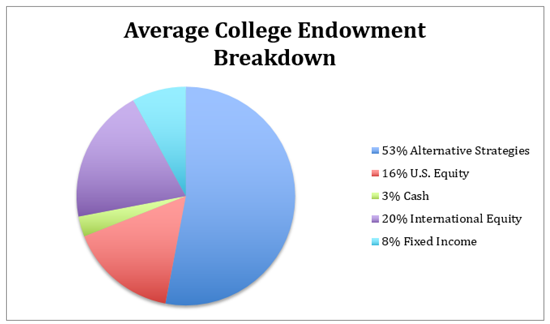

Most college endowments are complicated. But they don’t have to be. Here’s their typical allocation.

Source: 2018 NABUCO-TIAA Study of Endowments

“Alternative Strategies” represent the biggest piece of the pie. But don’t be afraid of that. Consider this: you spill a cup of sugar on the floor. You know you should clean it with a broom or vacuum cleaner. That’s the common sense approach.

In contrast, alternative strategies require more imagination. Imagine a bunch of quants trying to scoop up sugar with a credit card, several computer chips and a Journal of Financial and Quantitative Analysis. They could still do it. But it wouldn’t be efficient.

Instead, remember brooms and vacuum cleaners. You can rock this.

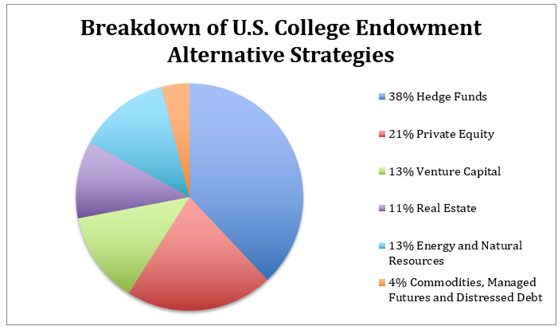

Most endowment funds use a complex compilation of alternative strategies. But they’re much more show than go.

Source: 2018 NABUCO-TIAA Study of Endowments

According to the 2018 NACUBO Report, an index comprising 60 percent U.S. stocks and 40 percent U.S. bonds beat most college endowments over the previous 3, 5 and 10 year periods.

Are you curious about the Ivy Leagues? A balanced index fund trounced most of them, too. I even met a 7-year old who had Harvard on the ropes.

This is great to know. You could set up an office in Tahiti. You could put everything in a balanced index or a couple of ETFs and pretend to work hard. Then go scuba diving every morning and learn the language in the afternoon. Once a year, call the college president. With a cool drink in your hand just say, “I beat most of my peers.”

The publication, Pensions & Investments also reports college endowment fund performances. They compiled 10-year performances for 34 college endowment funds to June 30, 2020. If you managed an endowment fund and stuffed everything into Vanguard’s Balanced Institutional Shares Index (60% stocks, 40% bonds) you would have beaten 77 percent of them over the past 10 years.

But 34 institutions is a small case sample. It’s also self-reporting. That means survivorship bias skews the average up. Researchers Sandeep Dahiya and David Yermack examined 35,262 U.S. non-profit endowment funds. They averaged their returns based on Internal Revenue Service filings from 2009-2018. On average, a balanced stock market index beat them by 3.97 percent per year.

If you apply to manage an endowment fund, the interview will be tougher than the job itself. Speak their lingo. Mention terms like, “alternative strategies,” “hedge funds,” “private equity” and “venture capital.” But if you get the job, remember brooms and vacuum cleaners. As codes for a balanced index, they’ll wipe most everybody’s floor.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.