Green Hydrogen: The Fuel of the Future

With the technology on its way to becoming mature, clean hydrogen investment projects are booming.

And share prices of companies active in this industry are skyrocketing.

Bertrand Beauté

20.08.2020

Will this time finally be it? Since the 1970s, hydrogen – or more accurately hydrogen gas (H2) – has been presented time and again as the solution to move away from oil and other fossil fuels. Now may finally be its time to shine. In early June, Germany approved an expansive €9 billion investment strategy to develop the industry. One month later, the European Commission unveiled its own hydrogen plan, estimated to cost between €180 billion and €470 billion by 2050.

“The announcement of Germany’s plan has revived excitement about the sector,” says Xavier Regnard, an analyst for investment bank Bryan Garnier & Co. As a result, the share prices of companies in this industry have skyrocketed. Since early 2020, the share price of US company Nikola has increased by more than 270%. In Europe, companies such as Ceres Power, ITM Power and McPhy Energy have seen their shares rise 100%, 265% and 540% respectively. None of these companies are currently profitable, but they all focus on hydrogen- related technologies that are now of increasing interest to governments, energy companies, industry players, and of course investors.

This isn’t the first time that the markets have spiked because of hydrogen, as investment bank UBS pointed out in a report published on 22 June. As early as 2000, the index covering companies in the industry saw its value increase sixfold before dropping sharply. “For decades, hydrogen was full of promise but was unable to deliver sufficient results,” said UBS analysts. Is a new hydrogen bubble forming now? “I don’t think so,” says Xavier Regnard, an analyst at Bryan, Garnier & Co. “Yes, the sector has seen excellent market performance since the beginning of the year. But it’s not immune to the reality of the situation. There is a real demand, real projects, and real opportunities. These technologies are starting to reach maturity, and given the climate crisis, it will be necessary to move to green hydrogen. During the first market spikes, the industry didn’t keep its promises and investors were disappointed. But this time seems to be it.”

“Hydrogen has long been relegated to automobile use, but there are indeed opportunities in all industries”

Thierry Lepercq, author of the book Hydrogène, le nouveau pétrole [Hydrogen: the new oil]

On paper, this colourless, odourless gas is very promising, a perfect fit for our current environmental needs. Water electrolysis is a process that can split a water molecule into hydrogen and oxygen via a simple electric current: “If the electricity used in the electrolysis is renewable and if the process takes place close to a water source, it is possible to produce hydrogen anywhere in the world, on demand, and in a completely clean way,” says Daniel Hissel, a 2020 CNRS Innovation medallist. In Switzerland, the Alpiq power plant, located along a river in Gösgen, has produced 100% clean hydrogen since February 2020.

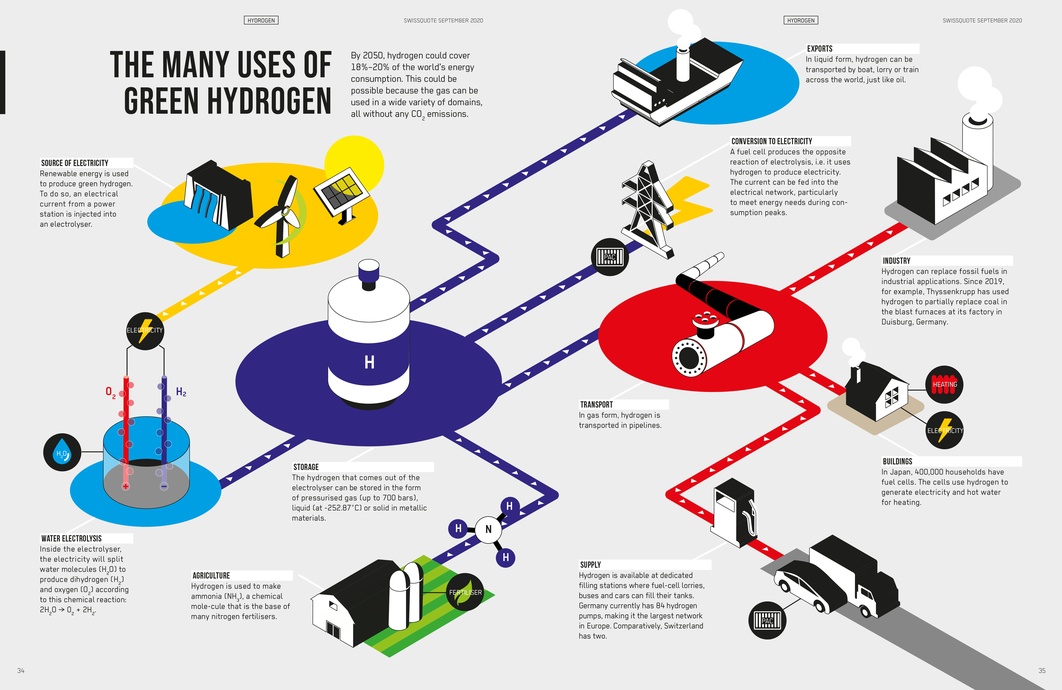

Once created, the gas can be stored in large quantities and transported in gas form via a pipeline, or in liquid form by boat or lorry. It can also be used for electricity or transformed into methane to supply houses and industry, or into fuel for cars, lorries, ships and aeroplanes. “Like oil, hydrogen is easy to store and transport,” said Thierry Lepercq, author of the book Hydrogène, le nouveau pétrole [Hydrogen: the new oil] and founder of the company SolaireDirect. “As a result, it can be a profitable replacement for fossil fuels in all applications (transportation, industry, energy). Hydrogen has long been relegated to automobile use, but there are indeed opportunities in all industries. It’s a phenomenal market.” By 2050, it could be worth $1,000 billion, according to HSBC, and potentially even $2,500 billion according to McKinsey – though these estimates came before the recent German and European investment strategies.

FROM BLACK HYDROGEN TO GREEN HYDROGEN

In 2018 – the most recent figures available – the hydrogen market was worth $130 billion, with an annual production of 74 million tonnes. This energy source was primarily used to produce fertilisers and refine oil products. But more than 95% of hydrogen currently produced is made from hydrocarbons (oil, natural gas or coal). This highly polluting process produces as much CO2 as the UK and Indonesia combined, according to the International Energy Agency (IEA). This type of hydrogen, called grey or black hydrogen, is not a solution to climate change.

To become the promised energy of the future, hydrogen must go green. “There are technologies that produce clean hydrogen. But they are more expensive than producing hydrogen with hydrocarbons,” says author Lepercq. “The challenge now is how to produce green hydrogen at a competitive price.” In 2018, it cost between $3 and $7.50 to produce 1 kilo of green hydrogen with an electrolyser, which is two to three times more expensive than production methods that use natural gas (grey hydrogen), according to the IEA.

“Sudden profitability is not a good indicator,” says Hissel. “If you only look at the price at the pump, you lose sight of the overall societal benefit of moving beyond fossil fuels.” But Lepercq disagrees: “When it comes to raw materials, everything needs to be at the right price. If you need to be subsidised, you’re not in the market and you’ll get nothing but crumbs. For hydrogen, a good price is $1 per kilo. Beyond that, it’s not competitive enough compared to oil.”

“Hydrogen is not a passing trend”

Hubert Girault, professor of physical and analytical electrochemistry at the École polytechnique fédérale de Lausanne (EPFL)

Even just a few years ago, that goal would have been completely unattainable. But the tides have turned. In June 2019, for the first time, the International Energy Agency (IEA) supported the use of hydrogen in a crucial report named simply “The Future of Hydrogen”. “Hydrogen is currently enjoying unprecedented momentum. The world should not miss this unique chance to make hydrogen an important part of our clean and secure energy future,” said Fatih Birol, executive director of IEA, in the report’s foreword. Why the sudden boom? The cost of hydrogen produced from renewable energy is falling faster than expected and the IEA estimates that clean hydrogen will become competitive by 2030.

“In fact, it will actually be much sooner,” says Lepercq. “In five years, we’re expecting a price of $1 per kilo. Some manufacturers are announcing a price of $1.50 starting in late 2020.” There are two reasons for this price drop. First, in order to produce green hydrogen, you need access to completely clean electricity from renewable and cheap sources. From 2009 to 2019, the cost of electricity produced in solar power plants decreased ninefold to reach $40 per megawatt-hour, and wind energy dropped from $135 to $41 per megawatt-hour, according to a study by Lazard Bank published in late 2019. “And prices will continue to fall in coming years, reaching $10 per megawatt- hour in 2025 with solar, which will automatically reduce the price of green hydrogen,” predicts Lepercq. The second reason is electrolysers – the machines that can transform water into hydrogen using electricity. “In recent years, the sector has gone from small pilot units – demonstrators with less than one megawatt of power – to industrial- scale projects that can reach 10, 20, and even several hundred megawatts,” says Xavier Regnard, an analyst at investment bank Bryan Garnier & Co. “This change in scale will lead to an industrialisation of the industry and a drop in prices.”

At the port of Rotterdam, for example, companies BP and Nouryon are planning to build a 250 MW electrolyser, which will be ready in 2025. Obviously, the sector’s industrialisation will be facilitated by government investment programmes. Germany is planning to produce 5 gigawatts (5,000 MW) of green hydrogen by 2030, and 10 gigawatts by 2040. “We’re laying the groundwork to become the global leader in hydrogen technologies,” said Peter Altmeier, minister for Economic Affairs and Energy. “Germany will be a pioneer, as we were 20 years ago with the promotion of renewable energies.” The European Commission is aiming for 6 gigawatts by 2024 and 40 gigawatts by 2030.

“Hydrogen is not a passing trend,” says Hubert Girault, professor of physical and analytical electrochemistry at the École polytechnique fédérale de Lausanne (EPFL). “Look at what happened in China: two or three years ago, the government began supporting this energy carrier. And when Beijing began supporting the industry, the country became the global leader, as we’ve seen with lithium- ion batteries and solar panels.” In 2017, Japan also implemented a hydrogen plan, followed by South Korea in 2019. Conglomerates such as Hyundai, Kawasaki and Toyota have invested in the industry for years and offer solutions that are already on the market.

Faced with the prospect of green hydrogen becoming the norm, traditional players – that run on grey hydrogen – are reacting accordingly. In 2019, Air Liquide acquired an 18.6% stake in Canadian company Hydrogenics Corporation, a specialist in fuel cells and electrolysis equipment to produce hydrogen. Also in 2019, German group Linde purchased a stake in UK electrolyser manufacturer ITM Power. Even oil giants such as BP, Total and Shell are getting heavily involved, creating dedicated hydrogen power subsidiaries. “The fact that giants such as Linde and Air Liquide are taking positions in the industry is a good sign,” says Regnard. “It shows that these companies also believe in the potential of green hydrogen.”

THE DIFFERENT SOURCES OF HYDROGEN

Except at the very depths of the oceans in interplate areas, hydrogen gas does not exist in a natural form on Earth. Unlike fossil fuels such as oil, hydrogen has to be made – as harnessing hydrogen a long way from the coast is not economically viable. There are several techniques to produce hydrogen, but not all of them are clean.

BLACK HYDROGEN

Hydrogen is produced using coal or lignite through a process called gasification. This method creates the most pollution, but fortunately it is no longer very common. The hydrogen produced costs between $1 and $2 per kilo.

GREY HYDROGEN

Hydrogen gas is produced from natural gas via a chemical reaction called steam methane reformation. This method is the most widely used today because it is inexpensive ($1 to $3 per kilo), but it produces a lot of CO2.

BLUE HYDROGEN

Hydrogen is produced via natural gas reformation in a similar way to grey hydrogen, but the CO2 produced is captured by filters, and then either reused or stored and not released back into the atmosphere. Blue hydrogen costs between $1.50 and $3 per kilo.

GREEN HYDROGEN

Hydrogen is produced by water electrolysis, i.e. splitting water molecules (H2O) into hydrogen gas (H2) and oxygen (O) using an electric current supplied by renewable energy (solar, wind, hydroelectric dam). This method has the advantage of not releasing any greenhouse gases, but it is expensive ($3 to $7.50 per kilo).