Andrew Hallam

13.11.21

Experts Say Stocks Are Going To Crash

_

I’ve been investing in the stock market for 32 years. Since I began investing, every week of every year a famous economist, a famous hedge fund manager or an esteemed journalist from a respected financial publication has headlined, “Stocks are heading for a crash.”

Some people, such as Rich Dad Poor Dad author, Robert Kiyosaki, say that every year. It’s like a blind man on a hill screaming all day long:

“It’s 2pm! It’s 2pm! It’s 2pm!”

At some point, yes, it’s going to be 2pm. But if you manage your investments based on stock market forecasts you would be flushing money down a toilet.

Instead of trying to time the market, invest regular sums into a low-cost diversified portfolio. Do it whenever you have the money. Europeans (and Canadians in Europe) increase their odds of long term success with an all-in-one portfolio of ETFs, such as those I recommend here. Australians or Canadians might be best served with one of these.

That means ignoring all forecasts. Warren Buffett says market forecasters exist to make fortunetellers look good. And after examining 6,582 market forecasts by market experts over a 7-year period, CXO Advisory, determined that Buffett was right.

Whenever an investor sends me a forecasted headline, I respond the same way. “I’ve been investing since 1989, and I saw headlines like this every week of every year.” Ben Carlson, in fact, did a fine job collecting some of these more recent headlines. Carlson is the Director of Institutional Asset Management at Ritholtz Wealth Management and author of A Wealth of Common Sense. He co-authored his most recent book, Invest Your Way to Financial Freedom with Robin Powell.

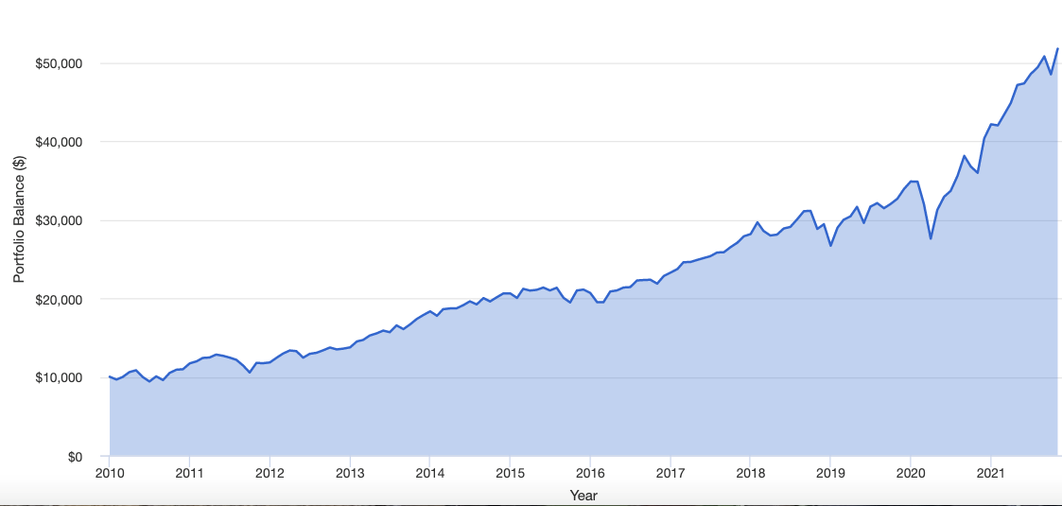

His website lists high-profile headlines that caught a lot of attention. Notice how silly they now look in light of the US stock market chart below.

US Stock Market Growth

January 2010 – October 31, 2021

Source: portfoliovisualizer.com, using Vanguard’s Total Stock Market Index: VTSMX

August 9, 2017: Is the stock market a bubble? (USA Today)

June 23, 2016: Uh-oh. Is the stock market in a bubble again? (CNN Money)

September 13, 2015: Fears grow over US stock market bubble (Financial Times)

May 6, 2014: Time to worry about stock market bubbles (New York Times)

December 2, 2013: Nobel prize winner warns of US stock market bubble (CNBC)

March 27, 2012: Robert Shiller eyes another tech bubble (Yahoo! Finance)

May 3, 2011: Why this stock market looks like the tech bubble of 2000 all over again (Business Insider)

January 11, 2010: US stocks surge back towards bubble territory (Business Insider)

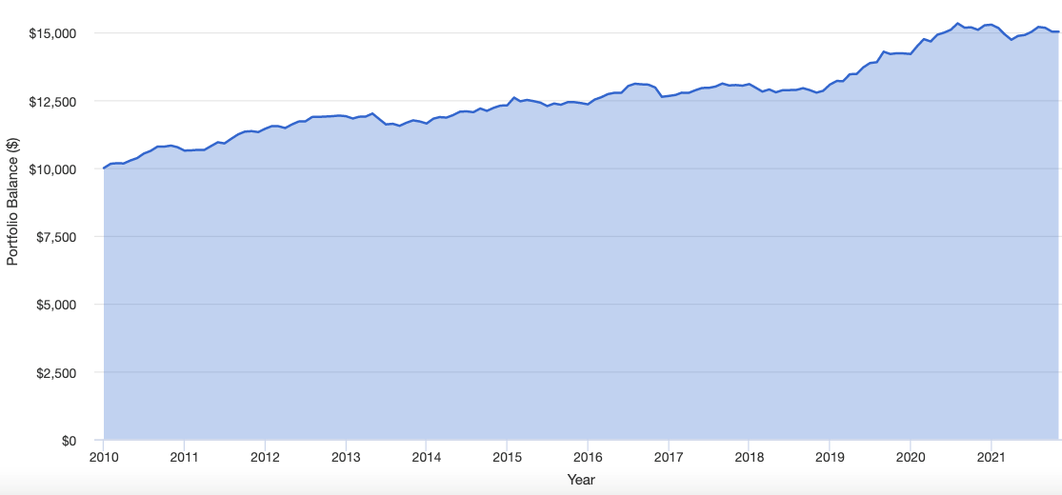

Forecasters don’t just seek attention trying to predict stock market drops. They do the same with bonds. Once again, you can see how silly the below headlines look in light of US bonds, with interest reinvested.

US Bond Market Growth

January 2010 – October 31, 2021

Source: portfoliovisualizer.com, using Vanguard’s Total Bond Market Index: VBMFX

August 1, 2017: Alan Greenspan: The bubble is in bonds, not stocks (CNBC)

October 9, 2016: Is the bond market in a bubble? (Wall Street Journal)

August 13, 2015: Is the bond market in a bubble? (US News)

October 5, 2014: Bond market may be more fragile than you think (USA Today)

June 9, 2013: When the bond bubble finally bursts a lot of investors will get hurt (Telegraph)

February 24, 2012: Is the bond bubble about to pop? (MarketWatch)

April 4, 2011: Is the bond bubble finally bursting? (CBS)

June 4, 2010: Bonds: Avoid the next great bubble (CNN Money)

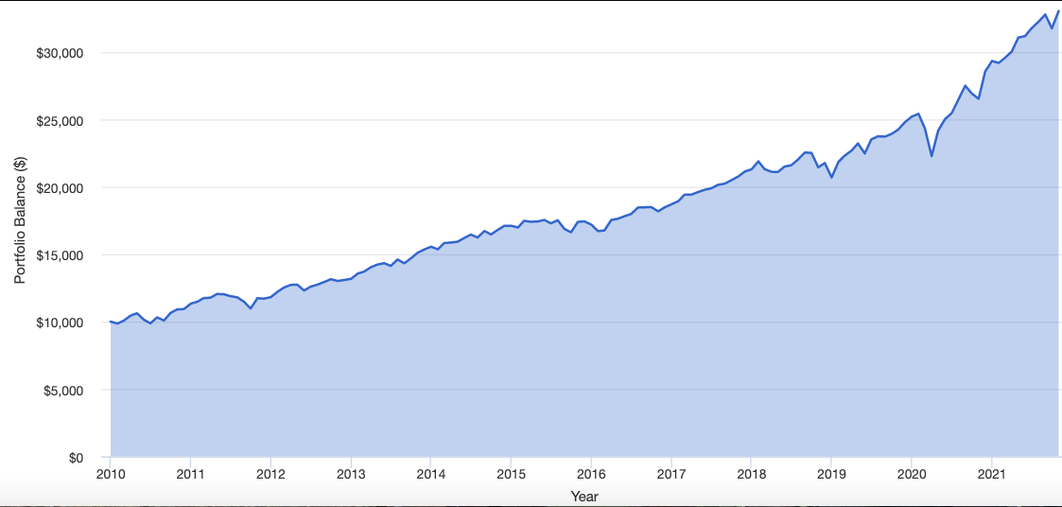

Carlson also points out that headliners are gaining attention by calling “the death” of portfolios comprising 60 percent stocks and 40 percent bonds. Once again, check out the performance of a 60/40 portfolio of index funds below, compared to the headlines saying it was done and dusted since…well, probably the dawn of markets.

Growth of 60% Stocks, 40% Bonds

January 2010 – October 31, 2021

Source: portfoliovisualizer.com, using Vanguard’s Balanced Index Fund: VBIAX

June 29, 2017: The way Wall Street has taught you to invest for the past 60 years may be dead (CNBC)

June 14, 2016: The 60/40 portfolio is dead and it’s not coming back (Forbes)

November 9, 2015: The 60/40 stock-and-bond portfolio is dead in 2016 (USA Today)

November 16, 2014: Investment managers are ditching 60/40 portfolio in favor of more liquid alternatives (Investment News)

November 27, 2013: Investors sticking to the 60/40 portfolio rule are likely to get badly hurt (Business Insider)

May 17, 2012: Why a balanced portfolio may not work (MarketWatch)

Warren Buffett is right. Stock market forecasters really do exist to make fortune- tellers look good. That’s why you should ignore all market forecasts. Stick to a low-cost diversified portfolio of index funds or ETFs. Add money as soon as you have it. Never try to time the market.

Long term, market timing is for suckers. And you don’t want to be a sucker.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.