Andrew Hallam

07.10.22

Four Great Businesses That Might Be Lousy Stocks For Years

_

If you wanted to buy a handful of stocks, which would you pick? I’ve been asking people that question for more than 20 years. Most people say, “fast-growing businesses with exciting prospects.”

That makes sense. But after a period of super returns, fast-growing businesses can become lousy stocks…sometimes for a decade.

I can hear what you’re thinking. If a company continues to earn record high business profits, that won’t happen.

But that isn’t true. It’s why legendary money manager Kenneth Fisher calls the stock market, “The Ultimate Humiliator.”

Fisher’s words might sound painful or prophetic if you bought a popular tech stock last year.

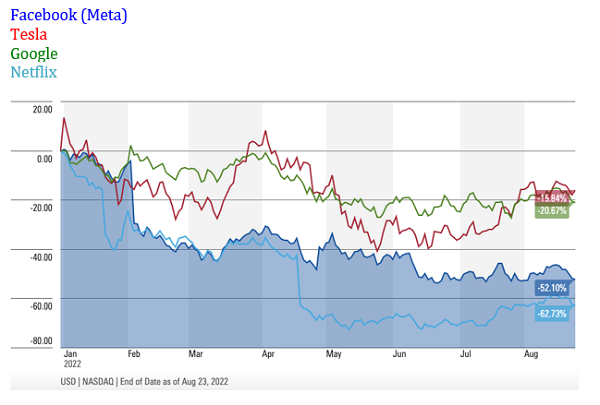

For example, if you invested $10,000 in Facebook (Meta Platforms), Tesla, Google or Netflix on January 1, 2022, that money would have plunged to $4,720, $8,416, $7,934 and $3,727 respectively by August 23rd. Those are painful kicks to the crotch…despite those companies earning record business profits.

Despite Their Record Profits, Stocks of Four Incredible Businesses Are

Having A Lousy Year

Source: Morningstar.com

Consider Netflix. The company’s net business income almost doubled from 2020 to 2021. And according to revenue generated during the first two quarters of 2022, Netflix is estimated to earn even higher business profits in 2022. Yet, from January 1, 2022 to August 23, 2022, Netflix’s stock dropped 62.77 percent. Similar stories of record profitability can be told for Facebook (Meta), Tesla and Google. But as shown above, their stocks sank too.

Sometimes, businesses earn year-over-year record-breaking profits while their stocks sink for years.

For example, Intel Corp was one of the world’s most popular stocks in the late 1990s. From 1990-2000, a $10,000 investment in Intel would have grown to $284,414. In 1999, I bought that stock, along (it seemed) with almost everybody else.

After the year 2000, Intel’s business profits continued to increase as home computers became as common as toasters. Intel’s chips were in most PCs. They might even have been in some hoity-toity toasters. Intel’s chips were in Apple’s computers, too. By 2004, Intel’s CEO, Craig R. Barrett reported:

“We ended 2004 with record revenues and robust demand for Intel architecture products…”

Sounds great, right? Intel ended 2004 with record revenues. But if you had invested $10,000 in Intel’s stock on January 2000 it would have sank to $5,784 by December 31, 2004, with all dividends reinvested.

This isn’t an aberration. The same thing happened to most of the world’s fastest growing (in terms of business earnings) blue chip technology stocks. They continued to earn record business profits. But their stocks stank. Below, you can see how the S&P 500 spanked the returns of Oracle, Cisco Systems and Microsoft from 2000-2014…despite those companies earning record business profits.

These Stocks Stank Despite Record Profit Growth

2000-2014

| Company | Net Income Growth 2000-2014 | A $10,000 investment would have turned into… |

|---|---|---|

Oracle | +74% | $16,977 |

Cisco Systems | +101% | $5,688 |

Microsoft | +134% | $11,080 |

|

|

|

S&P 500 Index |

| $18,359 |

Source for stock retuns including dividends: portfoliovisualizer.com

Source for net income: each companies respective annual report

Savvy stock buyers know it takes more than rising business profits and an exciting story to make a stock keep rising. Instead, there are three main influences.

Three Stock Price Influences

1. Rising business growth for the company

2. Company growth that meets or exceeds analysts’ and investors’ expectations

3. If the stock has been rising faster than the business’ earnings growth, a painful correction (or poor future performance) will eventually occur.

Cisco Systems, above, is a classic case of #2 and #3. From 2000-2014, the company continued to earn record business profits. But analysts and investors had expectations that the company couldn’t meet (#2). And because, from 1990-2000, the stock had risen far faster than its business earnings (#3), the chickens eventually came home to roost. That’s why Cisco Systems increased its net income by 101 percent from 2000-2014, while the stock’s 14-year return was down almost 46 percent.

Let’s bring this back to today. Most of the last decade’s feverishly popular technology companies also accompany sky-high expectations (#2). What’s more, over the past decade, their stocks also rose far faster than their business earnings.

That doesn’t mean your favourite technology stocks will continue to sink or languish for a decade. A couple of them might buck the trend. But do you know which? Nobody does. That’s why you should leave stock picking to the pros. And if you invest in a diversified portfolio of index funds, you’ll beat most of the pros anyway.

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.