Andrew Hallam

15.04.24

Should You Begin Investing Now, Or Wait?

_

Taking your first investment step can be scary. You want to be sure you’re doing the right thing. Perhaps you’ve already read everything you can about effective investing. You learned that the best odds of success come from a globally diversified portfolio of index funds.

But taking a committed leap can be so darn hard.

Charles Schwab said something I’ll never forget. He said we should imagine two people. One begins investing monthly today. The second person is nervous. They wait five more years. Unfortunately, that procrastination means the second person has to invest twice as much every month, if they want to build the same amount of wealth.

Twice as much each month! Could that be true?

If you have to invest twice as much, you might have to cancel your family’s vacation to Disneyland. You might have to cut back on visits to your favourite Italian restaurant. And if you can’t afford to invest twice as much, you might have to work a lot longer than you want.

But is Charles Schwab right? Do you really have to invest twice as much every month, if you wait five years before beginning your investment plan?

I wanted to find out.

Using portfoliovisualizer.com, I back-tested a portfolio of index funds comprising 70 percent global stocks and 30 percent global bonds. I looked at rolling periods starting in 1989. For example, I looked at what would have happened if someone started investing in 1989, instead of waiting five years, until 1994.

I then checked every rolling five-year period.

And here’s what I learned. On average, waiting five years meant someone had to invest about 72 percent more each month, compared to someone who began investing five years before.

Some periods, it was a lot more than that.

For example, imagine two retirees. They each have $5 million in March 2024.

One of them started investing in 2009. The other started investing five years later, in 2014.

The person who started in 2009 would have needed to invest $15,820 a month to reach $5 million. But the person who started just five years later (in 2014) would have needed to invest a whopping $29,700 a month. That’s almost 88 percent more every month!

How about someone who started investing in 2014 compared to someone who started five years later, in 2019? If they both had $5 million by February 28, 2024, the procrastinator would have needed to invest 133 percent more each month.

But what if the earlier bird began investing during one of the worst times in history? One such example would have been the year 2000. From 2000 to 2010, US and global stocks moved up and down. But they didn’t gain ground. In that case, would it have been better to begin in 2005, instead of 2000?

Get International Investing insights

in your inbox once per month

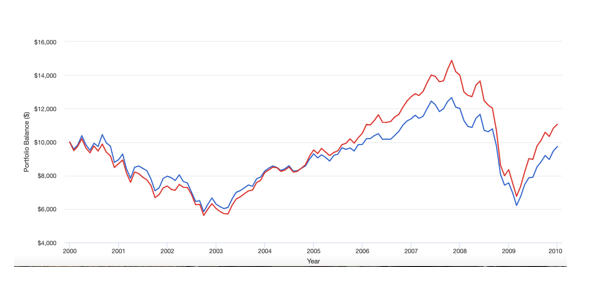

Below, I’ve shown how the global and US stock markets performed from 2000-2010, including reinvested dividends.

Would You Pity The Monthly Investor Who Started In 2000?

Source: portfoliovisualizer.com

To have $5 million by March 2024, the person who began investing in January 2000 would have needed to add $5,730 a month.

Are you curious about the second person? They procrastinated, beginning their monthly investments in 2005. And that cost them dearly. To have the same amount of money, they would have needed to invest $9,350 per month.

Here are the two scenarios side by side

| Dollar Cost Averaging, Starting January 2000 | Dollar Cost Averaging,Starting January 2005 |

Monthly Invested | $5,730 | $9,350 |

Total Money Added | $1,661,700 | $2,150,500 |

End Value | $5 million | $5 million |

How is that possible?

When investing monthly, the more time our money spends in the market, the better. That’s why it’s best to begin investing right away.

And what if you inherited a lump sum? You might wonder if you should invest it all at once. If you’re sitting on the sidelines, trying to decide, let me help with that.

First, nobody can see the future. However, almost 70 percent of the time, investing a lump sum as soon as you have it, beats splitting the money and investing it in chunks. In this article, I referenced that research.

That’s why, if I inherited money today, I would invest it right away.

No questions. No hesitation.

Many investors exhibit a failure to launch. Perhaps you’ve been burned by an investment linked assurance scheme. Perhaps you’re trying to speculate about the best time to start. Perhaps you’re questioning which are the best investment funds.

I respect those fears.

But if you haven’t started investing, take the first step today.

Start now.

If you don’t, it could cost you hundreds of thousands, or even several million dollars.

You can do this.

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.