Andrew Hallam

12.07.2021

Should You Buy a Stock that’s Poised to Join the S&P 500?

_

Investors pin high hopes on stocks that are poised to join the S&P 500. They believe that when index fund providers add such shares, the companies stocks will soar. But in this article, Andrew Hallam explains that’s not the case.

About six months ago, Tesla joined the S&P 500. The news caused frenzy on several levels. Plenty of investors said it didn’t belong there. Yes, Tesla made great cars, but they hadn’t yet recorded a single profitable year. Tesla, as a business, lost money every year from 2009 to 2019.

Fans of the stock’s addition, however, looked to the future–one they hoped would offer a golden ride. After all, when a new stock joins the S&P 500, every fund company with an S&P 500 ETF or index fund has to buy its shares. Based on supply and demand, that should lift the share price.

Unfortunately, it rarely works like that. Most newcomers to the S&P 500 don’t perform well. Analysts and individual investors put a price on stocks during every trading day. They often rapidly buy and sell. If a stock rises above what they deem its intrinsic value, a lot of selling takes place. As such, when investment firms bought Tesla’s shares to add to their S&P 500 index funds, plenty of active fund managers and institutional investors sold their Tesla shares. That created a market balance, not a soaring price for the newly added stock.

In fact, stocks that get added to the S&P 500 typically underperform the stocks they replace. As Research Affiliates notes, over the past 20 years, 23 stocks were dropped from the S&P 500 and 23 were added. Six months after each addition and deletion, the stocks that were dropped outperformed the stocks that were added by 14 percent. After twelve months, that performance gap widened to 20 percent.

And when those new additions are big, the biggest gaps occur. That’s because newly added stocks often sport high price-to-earnings ratios. Such was the case with Tesla. It was the largest addition (based on market cap) to ever enter the S&P 500 when it replaced Apartment Investment and Management Co. (AIV).

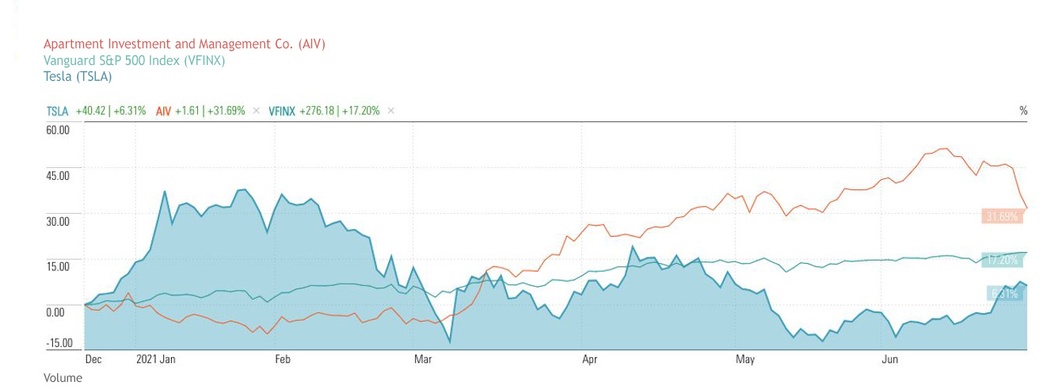

Between December 21, 2020 (when Tesla was added) and June 30, 2021, Tesla’s shares gained 6.31 percent. At first blush, that doesn’t look shabby. But it was a poor return compared to the S&P 500. It gained a whopping 17.20 percent over the same time period. As for the stock that got dropped from the index, Apartment Investment and Management Co. (AIV) gained 31.69 percent. In other words, six months after getting ditched from the S&P 500, AIV outperformed Tesla by about 25.38 percent.

New Additions to the S&P 500 Typically Underperform The Stocks They Replace

Source: Morningstar.com

Wharton professor Jeremy Siegel would say this isn’t an aberration. In his 2005 book, The Future For Investors, he described tracking the S&P 500 stocks from the mid 1950s. But when Standard & Poor’s added and deleted stocks, Siegel ignored those changes. Instead, he tracked those original 500 stocks. Some merged with other companies. Others went bankrupt. But Siegel learned something astonishing. Those original 500 stocks beat the performance of the S&P 500 index. In other words, when Standard & Poor’s dropped stocks from the bottom of its ladder and replaced them with popular stocks, it hurt the performance of the index.

It’s natural to believe that inclusion into the index will lead to great performance for newly added stocks. But intuition, it seems, is a bad barometer. If you must speculate, instead of rushing into a stock that’s joining the S&P 500, consider buying shares in whatever’s kicked from the house instead.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.