Finimize in partnership with Swissquote

18.05.23

Sustainable investing in the next decade

_

Sustainable investing has taken off especially quickly in Europe but it’s facing a lot of political backlash in the US, with its relevance increasingly questioned against a low-growth and inflationary backdrop. This piece is the first of two in the Swissquote Environmental, Social, and Governance (ESG) series, targeted at investors who are thinking about incorporating ESG into their investment framework. This first article will prompt investors to consider what sustainable investing looks like to them, and to decide whether it has a place in their portfolio over the next decade by examining the value of sustainable investing and addressing the theme’s challenges, trends, and outlook.

There are four main ways to invest sustainably. Returns are important, of course, but it’s arguably far better to make returns while investing in the causes that matter to you. And while the subsection of Environmental, Social, and Governance (ESG) investing has taken off in the last few years, there are a few different – lesser known – ways to invest sustainably.

ESG integration:

This approach incorporates the lens of ESG metrics – alongside traditional financial analysis – to identify strong businesses that can generate high returns sustainably, while mitigating risks traditionally associated with ESG.

Exclusionary screening:

Here, you would exclude any stocks that don’t align with your moral and ethical values, regardless of how well they’ve performed. Typical examples include alcohol, tobacco, and fossil fuel companies.

Sustainability-themed investing:

If you have an issue you’re particularly concerned about, like climate change for example, you can actively invest in stocks or exchange-traded funds (ETFs) that are exposed to the theme.

Impact investing:

These investments tend to be project-specific and long-term in nature, like microfinance, say. The aim here is to provide a measurable impact through your investments, usually with a specific outcome in mind.

If the idea of sustainable investing resonates with you, you’ll need to decide which investment approach suits you first. That could be to invest only in sectors with the highest ESG scores, or to simply exclude companies that don’t fit with your values. Remember, though, that these choices should ultimately align with your financial goals and risk appetite.

There’s more to ESG than that feel-good factor.

The value of incorporating ESG metrics in your investment decisions has been historically difficult to test: see, data is often incomplete and not standardized, particularly for smaller or emerging market companies. So while it is worth knowing the value that ESG can bring to investing, you should examine most of these results with a critical eye. Still, though, the majority of studies show that picking stocks with high-ranking ESG metrics can help you outperform the market.

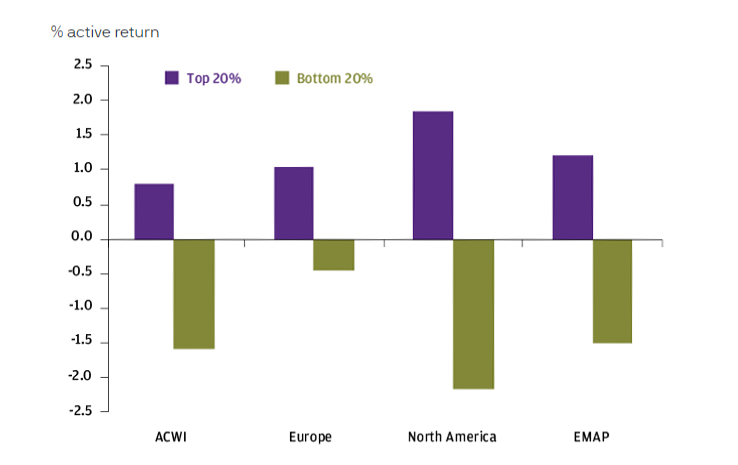

Source: J.P. Morgan Asset Management.

The chart above shows the performance of companies that have been ranked under J.P. Morgan Asset Management’s proprietary ESG scores . You can see that those with the top 20% of ESG ratings outperformed those in the bottom set across four regions from 2012 to 2021, with the starkest difference in North America. And another recent study also concluded that this apparent improved financial performance due to ESG becomes more marked over a longer time horizon.

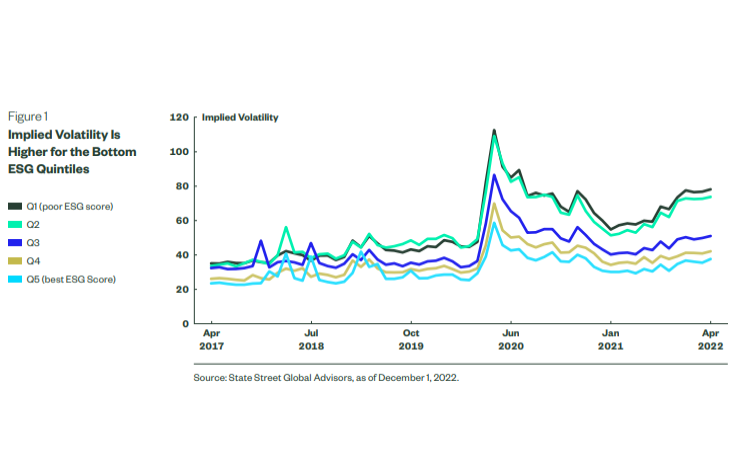

What’s more, the positive impact that high-ranking ESG stocks can have on a portfolio goes beyond higher returns. Studies have shown that those stocks also tend to have lower volatility, a key measure of financial risk, meaning they could improve your portfolio’s risk-adjusted returns.

That said, other studies suggest that the ESG market is reaching maturity and its outperformance has already started slowing, with risks of unwinding. A stock with a good ESG rating tends to command a higher premium, meaning potentially lower investor returns.

Get International Investing insights

in your inbox once per month

The risks and challenges that come with sustainability.

Still, sustainable investing is not without its challenges. Firstly, a lack of clear information can make it hard to compare investment opportunities. The industry’s quick development has given rise to many different standards and frameworks – but adhering to these guidelines is voluntary, so companies and investment funds have no consistent approach to disclosing their ESG performance. And for you, the lack of standardized data makes it difficult to compare companies’ ESG performance consistently, potentially leading to discrepancies in your investment decision-making.

That has a knock-on effect: increasing the risk of “greenwashing”. And that’s your second challenge: companies or investment funds can give the impression that their products or services are a lot more environmentally friendly or socially responsible than they really are. Greenwashing’s a big problem, since it can result in you making misinformed investment decisions that can ultimately hurt your returns.

The third challenge is the concentration of ESG funds and companies in certain sectors – specifically growth ones like Big Tech. Now, in 2022 the majority of sustainable funds significantly underperformed the US market precisely because they were underweight in traditional value stocks like energy and defense companies. And when you look forward, a lack of diversification could mean sustainable investing might suffer when there’s a style rotation from growth to value.

Finally, remember that the industry isn’t shielded from the effects of politics. In the US, political conservatives believe that companies are too preoccupied with ESG concerns, sacrificing their main focus of shareholder profits. This backlash could threaten the near-term growth of sustainable investing in the US.

Sustainable investing will change over the next decade.

Sustainable investing is still in its early days, so it’s not surprising that as the movement matures, it will look vastly different in the next decade compared to the last.

Most importantly, it’s true that your returns may not be as high when you invest sustainably. After all, ESG funds underperformed the market in 2022, driving record outflows in the US over the year. Plus, a recently published academic study revealed that sustainable investing was more likely seen as a fair-weather option, with investor demand varying based on income shocks and economic stress. In the future, then, any outperformance is less likely to be driven by fresh rampant demand, so you’ll want to be more discerning when assessing opportunities.

It’s going to be harder to pick out sustainable investments going forward too. In the near term, new European regulations created to tackle “greenwashing” have significantly shrunk the market. BlackRock, Amundi, and Pictet – three giants of the fund management world – removed the ESG label from €175 billion worth of funds earlier this year, reducing the size of the market by 40%.

Still, if sustainable investing is close to your heart, you shouldn’t be put off by the recent changes and turmoil in the market. Instead, just bear in mind that the shake-up means you need to think harder about your investment strategy. More stringent ESG labeling could well mean that certain sectors – like renewables, clean energy, and waste reduction and processing – may see disproportionate interest. But not every sustainable company that’s currently successful will play a major role in the future, so before you invest, consider which companies and sectors are actually needed for the world to hit its global net-zero targets.

¹ https://am.jpmorgan.com/hu/en/asset-management/institutional/insights/m…

² https://www.stern.nyu.edu/sites/default/files/assets/documents/NYU-RAM_…

³ https://www.ssga.com/library-content/pdfs/ic/link-between-volatility-an…

4 https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3878314

5 https://www.bloomberg.com/news/articles/2022-12-07/big-esg-funds-are-do…

6 https://www.ft.com/content/153c8555-e4d0-4c59-88f0-368656fbb3ad

7 https://www.cambridge.org/core/journals/journal-of-financial-and-quanti…