Andrew Hallam

25.03.2021

What Investors Can Learn From Crazy and Not-So-Crazy Brits

_

The British have long had a reputation for betting on almost anything. But that doesn’t make them crazy. When the odds are low, the rewards are high. And when the odds are high, the rewards are low. It’s common to see big bets on whether aliens exist, who will win an Oscar (and whether they’ll cry during the acceptance speech). Several bets have been placed on which year the world will end. Good luck collecting on that one.

To be fair, betting is prolific in every country. And when veteran bettors place wagers, they typically know the odds. If you place a bet, for example (as some Brits have!) that your child will star for Manchester United, the bookies will want to know everything about you and your kid. That helps bookies define the odds and it helps bettors make more informed decisions.

Investors in actively managed funds could learn a lot from this. After all, few of them know their odds of beating the market or how much they could win.

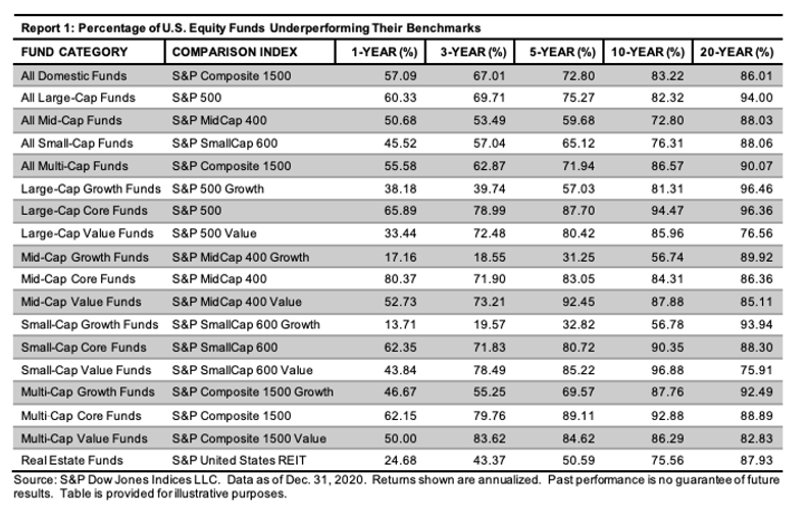

According to the SPIVA Scorecard, the long-term odds of buying an actively managed fund that will beat its benchmark index are low. As such, the payoff should be huge. But that’s not the case.

Imagine this scenario:

A Manchester United soccer player carries his 1-year-old son into a British betting house. The bookie acquires all kinds of information about the father and his mother. Assume he then determines the boy’s odds of success are 1 in 7. You figure this might be your chance to win really big. Under normal circumstances, betting on a seven-to-one underdog would see you winning seven times your money if the bet panned out.

But what if the bookie said this? “If you bet $1,000, and the kid makes it, you’ll earn about a $20 profit. And if the kid doesn’t make it, you’ll lose $50.”

If that happened, you wouldn’t likely pull a muscle reaching for your credit card.

Investors in a diversified portfolio of actively managed funds won’t likely post an overall loss over a period of ten years or longer. But that Manchester United bet still has plenty in common with these products. For example, based on SPIVA’s research, the odds of picking an actively managed fund that will beat a broad U.S. stock market index are about 1 in 7, too. That’s based on the fact that about 86 percent of actively managed U.S. funds trailed the U.S. market over the 20 years ending December 31, 2020. As shown below, actively managed funds in 18 categories posted similarly poor results over 20-year periods.

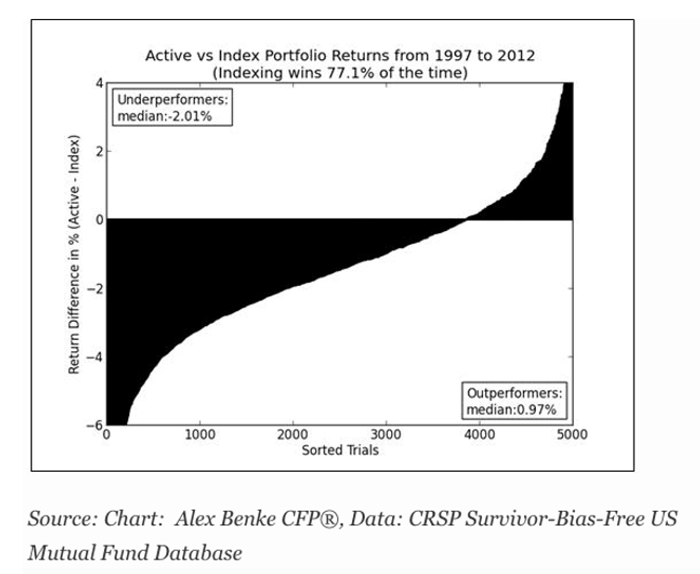

If you invested with actively managed funds, you would be saddling your money with a 7:1 underdog. And if your gamble paid off, you should expect to beat the market by about 0.97 percent per year. However, if you invest with index funds (a 7:1 favorite) you should expect to beat the typical actively managed fund by about 2.01 percent per year. That’s according to Alex Benke, based on research he conducted between 1997 and 2012.

Few veteran punters would wager on that bet… if they knew the odds. Even fewer would take that gamble if they saw research from the SPIVA Persistence Scorecard: top-performing actively managed funds during one measured time period usually underperform the next. That’s why, choosing to buy actively managed funds over index funds is one of the silliest bets you could make, after betting on the date that the world will end, of course.

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller, Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.