Andrew Hallam

12.05.23

When Should You Worry About Your Portfolio’s Returns?

_

A guy I’ll call Bruce recently emailed me in a tizzy. Every month, he had been adding money to his portfolio. But in 2022, his portfolio dropped by several hundred thousand dollars. “Where did I go wrong?” he asked. “And should I stop adding money?”

If you’re one of my regular readers, you might expect me to say, “Ignore the market’s movements and your portfolio’s value. Just keep adding money.”

I’m not saying that now. This time, I’m saying you might need to swap your investments for something different.

Before calling your advisor or jumping into your brokerage account, let me provide some context that might, at first, sound crazy:

During some years, your portfolio might gain or fall by 5 percent. Depending on what you own, I might suggest you make a change. Other years, your portfolio could plunge 20-25 percent. This time, depending on what you own, I would suggest you stay put, and keep adding money.

This might sound a bit like Mad Hatter babble.

Imagine Alice in Wonderland for a moment. She sees a white rabbit and chases it down a hole. She enters a small room and sees a tiny door. Alice then drinks something that makes her small, so she can get through the entrance. Then she eats what she shouldn’t, and suddenly grows huge…crammed like a salmon in a goldfish bowl.

Plenty of people invest like this. They chase white rabbits in the quest for something great. And if they make money, they bear down on those fluffy tails. They believe they’re doing well when they see their investments rise. But chasing rabbits always, eventually, leaves us crammed in a tiny place.

This happened in the late 1950s with electronic stocks. White rabbits said, “This is a new era.” Any stock with the suffix “tron” at the end of its name soared like crazy. Investors shunned diversification to chase these stocks. Warren Buffett himself said the world had gone nuts. He even closed his Limited Partnership (a private fund he ran before becoming CEO of Berkshire Hathaway). After several years of “easy gains” those “tronic” stocks crashed. Investors would have been better off if they had never gone near them.

It happened again in the late 1990s with dotcom stocks. Once again, we entered a “new era” where investors often said, “Business earnings no longer matter.” I bought stock in Nortel Networks, among several other darlings. And for a few years, I looked like a genius. But I soon became a salmon in a goldfish bowl. Technology stocks, like Nortel, crashed. Many never recovered.

Get International Investing insights

in your inbox once per month

And that’s my point. If we own a globally diversified portfolio and it drops in value, that can be a gift. We can take advantage of lower prices, and when they recover, we can earn big gains. After all, the global markets won’t go bust. Individual stocks, however, can. And red-hot sectors (even when those stocks survive) can turn cold for years.

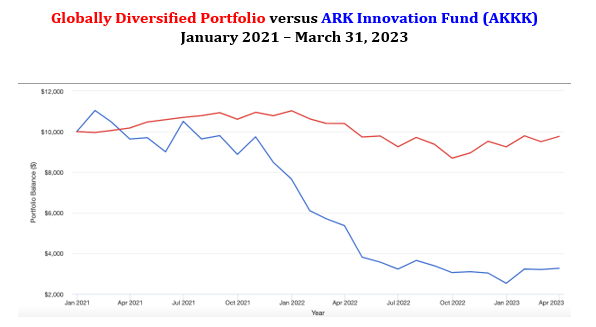

Over the past several years, we saw history repeated itself. Rabbits, once again, promised easy gains. Investors raced into holes during this new era. In 2020 and 2021, previously unknown fund managers, like Cathie Wood, breathlessly told investors to buy ARK Innovation funds and their new economy stocks. Investors pegged hopes on the future of this new paradigm. Then those stocks crashed…wiping out plenty of hype-filled gains.

In fact, if you put $10,000 into Cathie Wood’s flagship fund when the rabbit called the loudest (January 2021) it would have shrunk like Alice to just $3,267 by March 31, 2023. To get back to even, this fund will need to gain 206 percent.

Will it recover?

Maybe.

Maybe not.

Source: portfoliovisualizer.com

In contrast, during this same time period, a portfolio with 60 percent invested in global stocks and 40 percent in bonds dropped less than 3 percent. The same $10,000 fell to $9,765 by March 31, 2023.

In 2022, globally diversified portfolios (depending on how they were allocated) fell between 12 percent and 18 percent.

Will they recover? Yes.

They include American stocks, European stocks, Emerging Market stocks and a slew of stocks in between. They include popular growth stocks and deep value stocks. They also include bonds. Globally diversified portfolios don’t go bankrupt. Nor do they stay cold for long.

Bruce owns a globally diversified portfolio of index funds. So when he emailed me with worry, I said, “Celebrate the discount and keep adding money.” I wouldn’t say the same if he had fallen in a rabbit hole.

Andrew Hallam is a Digital Nomad. He’s the bestselling author Balance: How to Invest and Spend for Happiness, Health and Wealth. He also wrote Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

Swissquote Bank Europe S.A. accepts no responsibility for the content of this report and makes no warranty as to its accuracy of completeness. This report is not intended to be financial advice, or a recommendation for any investment or investment strategy. The information is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Opinions expressed are those of the author, not Swissquote Bank Europe and Swissquote Bank Europe accepts no liability for any loss caused by the use of this information. This report contains information produced by a third party that has been remunerated by Swissquote Bank Europe.

Please note the value of investments can go down as well as up, and you may not get back all the money that you invest. Past performance is no guarantee of future results.